In a widely reported note released this week, the bank said the "strategic case for owning commodities has rarely been stronger".

They pointed out commodities had been the best-performing asset class of 2018 and were up 7% year-to-date, outperforming equities by 8%.

"As the business cycle deepens and inflationary concerns push interest rates higher, cross-asset correlations with commodities decline and the diversification benefits of owning commodities rises with higher rates," they said.

Goldman Sachs had changed its tune on gold in March, saying rising US interest rates might not be the threat to gold some feared.

They have forecast the gold price to hit US$1,450 an ounce by the end of the year - it was trading around $1,308/oz on the spot market earlier today, having softened of late as the US dollar strengthened.

The analysts also tipped copper to reach $8,000 a tonne in December, Bloomberg reported, adding there was "significant upside" to its forecast for 2019.

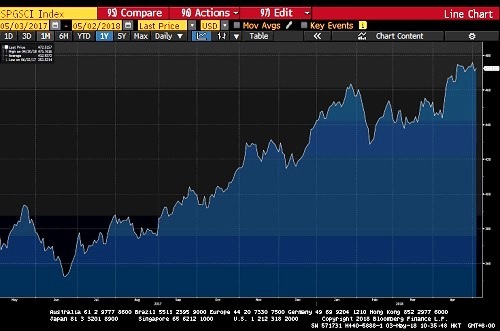

The Bloomberg graph below charts the rise of the Goldman Sachs Commodities Index over the past year.

GSCI chart. Source: Bloomberg