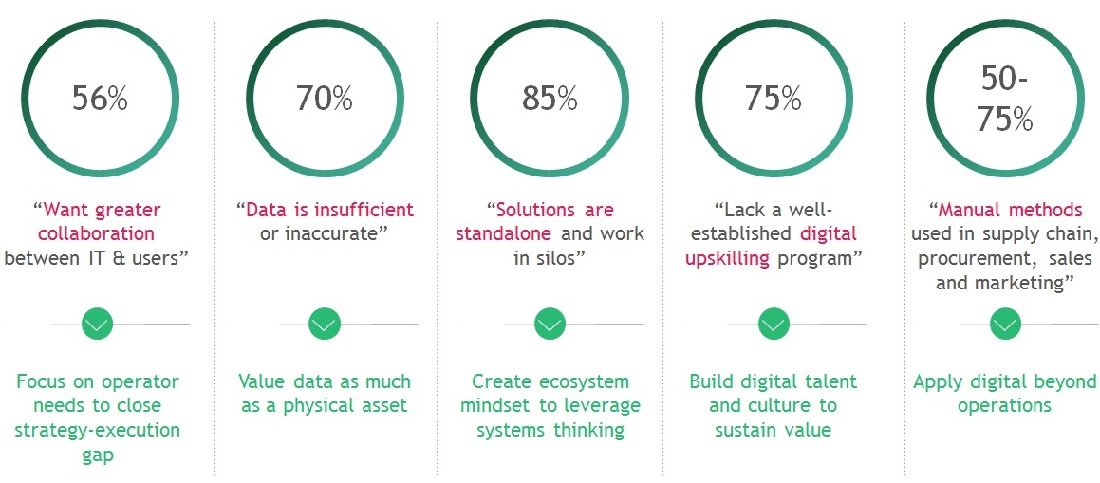

It doesn't have to be this way. Data from BCG's Digital Acceleration Index (DAI) suggests that by activating five accelerators, miners can fast-track sustainable and value-creating digital adoption. In our work with clients in the mining industry, we've seen such adoption deliver impressive results, including 5-10% increases in throughput and 2-5% increases in yield and recovery.

With these advantages in mind, let's take a closer look at the accelerators.

Accelerator 1: Focus on operators' needs

Of all the industries covered in the DAI, metals and mining shows the biggest gap between companies' ability to craft a digital strategy and their ability to put that strategy into action to generate the intended new value (figure 1 above).

The good news is that mining companies have the power to close the gap. Our analysis of miners that excel at executing digital strategies shows they take an operator-centric approach to developing digital solutions. That is, they customise them to each mine's unique characteristics, such as the orebody, beneficiation process, quality of raw materials, and operators' skills.

For instance, operators at a large Russian mining company resisted fully adopting an off-the-shelf fleet management system because it hadn't been tailored to their day-to-day operations. But the algorithm was normalised for changing mine faces and adjusted to display granular mining KPIs as well as to simplify the front-end design. Once these changes were made the operators embraced it. The effort paid off with a 20% improvement in equipment utilisation.

However, customised solutions don't just happen. To ensure solutions meet operators' needs and thus get adopted, mining companies that stand out in delivering digital solutions regularly incorporate operators' input into the development and deployment of digital applications. Weekly meetings between developers and operators and agile ways of working have ensured that designs meet users' needs and that adoption of digital solutions remains strong after implementation.

Accelerator 2: Value data assets as much as physical assets

Capturing the data essential to so many digital solutions isn't easy. Sensors are pricey, and installing them can be difficult and time consuming, especially for miners with operations in remote locations characterised by rugged terrain and poor network bandwidth.

To surmount these data-capture challenges, consider installing low-cost sensor boxes. These no-frill sensors can be installed in less than two hours. What's more, they capture only vital information that can provide predictive maintenance alerts, such as data on temperature, vibration and noise levels.

To efficiently store all the data captured from a mine or plant, some companies are combining traditional data warehousing models with new data and digital platforms, such as edge and cloud computing. This approach can lower data-storage costs and enhance data-accessing speed.

Accelerator 3: Adopt an ecosystem mindset

When it comes to digital solutions, the whole is often greater than the sum of its parts. So think about building interconnected solutions on the same digital foundation. Internal ecosystems are key to this effort. Instead of developing standalone digital solutions that operate in siloes, combine them to create a multiplier effect.

A large copper mine in Chile combined a machine learning model for optimising copper recovery at the concentrator plant with its mineral tracking system at the mine. This combination enabled the company to adjust operating parameters according to different types of mineral clusters. This resulted in greater recovery yields that demonstrated the benefits of a truly integrated mine-to-plant optimisation.

Accelerator 4: Build digital talent

Most mining companies have adopted traditional operational improvement tools, such as Six Sigma and lean business principles. Now they need to add digital strategic thinking and upskilling to this toolbox, for all levels in the organisation.

At the senior leadership level, for instance, one mining company made arrangements for executives to visit digital centres and industry start-ups. They were able to see firsthand how digital technology was helping to solve the same kinds of problems their company was facing.

For middle managers, miners can build incentive structures that allow these managers to take measured risks and that give them time to show results. One company assigned managers to work closely with shop-floor teams to identify where digital solutions could solve business problems, and then to implement those solutions to become business as usual. The middle managers ended up feeling a strong sense of ownership of the digital transformation. That sense of ownership, in turn, improved the odds that adoption of the solutions, along with results gained from implementing those solutions, would be sustained.

For shop-floor teams, mining companies can show how digital tools solve real-world problems. Action Learning certification programmes that apply advanced digital tools to various business situations can help give trainees a common language to communicate with developers. Equally important, these programmes can encourage teams to adopt digital tools in their day-to-day jobs, further helping to ensure that the advantages gained from deploying digital will be sustained.

Accelerator 5: Apply digital tools across the organisation

Many mining companies have focused their digital efforts on improving operations, and they've generated impressive results from doing so. However, digital opportunities in operations are narrowing, as more and more companies invest in such initiatives. Consequently, the most forward-thinking miners are starting to apply digital to other functions, such as procurement.

Relying on manual or disparate systems for procurement can lead to stockouts, excess or incorrect inventory or delays in processing purchase orders. Digitising procurement processes can help miners avoid these problems. Many of BCG clients have moved to a QR-based ordering solution, which automates all the standard background processes and reduces the purchase order process to a single click. In more advanced applications, companies have deployed AI-based negotiation coaches to help purchase teams arrive at more favourable contract terms with vendors.

Finance is another case in point. Digital solutions are enabling finance officers to move away from spreadsheets and to improve financial planning. To illustrate, during the COVID-19 pandemic, managers have used these advanced tools to quickly model complex and multivariate scenarios related to factors such as demand recovery, commodity price movements and supply chain disruptions. These models have helped managers provide valuable inputs to leaders who are crafting business strategies as the pandemic has played out.

What industry leaders are saying

Next steps for miners

Mining companies fall on a wide digital spectrum, according to data from the DAI. Each company has adopted a different approach to digital, depending on its current state, business context and external environment. Still, much remains to be done in order for miners to close that digital strategy-execution gap--and thus to reap the full benefits on offer from digital.

Understanding and deploying the five accelerators above constitute excellent starting points for miners seeking to advance more speedily in their own digital journeys--while creating value that can be sustained long into the future (figure 2 above).

*Agustin Costa (costa.agustin@bcg.com) is a managing director and partner, Saurabh Harnathka (Harnathka.saurabh@bcg.com) is a principal, and Mikhail Volkov (Volkov.mikhail@bcg.com) is a managing director and partner, at BCG. This article is excerpted from "Racing toward a Digital Future in Mining," co-written with Amit Ganeriwalla and Nicole Voigt.

INVESTMENT

Accelerating toward mining's digital future

Mining companies are investing heavily in digital technologies. But many of these investments aren't delivering the hoped-for benefits, which can include greater throughput and yield, simplified processes, lower costs and reduced carbon footprint. The reasons for lower-than-anticipated returns on digital investments include cultural resistance to incorporating digital into centuries-old processes and unfamiliarity with digital solutions, to name just a few.

The strategy-execution gap in metals and mining. Source: BCG Analysis, DAI Survey

It doesn't have to be this way. Data from BCG's Digital Acceleration Index (DAI) suggests that by activating five accelerators, miners can fast-track sustainable and value-creating digital adoption. In our work with clients in the mining industry, we've seen such adoption deliver impressive results, including 5-10% increases in throughput and 2-5% increases in yield and recovery.

With these advantages in mind, let's take a closer look at the accelerators.

Accelerator 1: Focus on operators' needs

Of all the industries covered in the DAI, metals and mining shows the biggest gap between companies' ability to craft a digital strategy and their ability to put that strategy into action to generate the intended new value (figure 1 above).

The good news is that mining companies have the power to close the gap. Our analysis of miners that excel at executing digital strategies shows they take an operator-centric approach to developing digital solutions. That is, they customise them to each mine's unique characteristics, such as the orebody, beneficiation process, quality of raw materials, and operators' skills.

For instance, operators at a large Russian mining company resisted fully adopting an off-the-shelf fleet management system because it hadn't been tailored to their day-to-day operations. But the algorithm was normalised for changing mine faces and adjusted to display granular mining KPIs as well as to simplify the front-end design. Once these changes were made the operators embraced it. The effort paid off with a 20% improvement in equipment utilisation.

However, customised solutions don't just happen. To ensure solutions meet operators' needs and thus get adopted, mining companies that stand out in delivering digital solutions regularly incorporate operators' input into the development and deployment of digital applications. Weekly meetings between developers and operators and agile ways of working have ensured that designs meet users' needs and that adoption of digital solutions remains strong after implementation.

Accelerator 2: Value data assets as much as physical assets

Capturing the data essential to so many digital solutions isn't easy. Sensors are pricey, and installing them can be difficult and time consuming, especially for miners with operations in remote locations characterised by rugged terrain and poor network bandwidth.

To surmount these data-capture challenges, consider installing low-cost sensor boxes. These no-frill sensors can be installed in less than two hours. What's more, they capture only vital information that can provide predictive maintenance alerts, such as data on temperature, vibration and noise levels.

To efficiently store all the data captured from a mine or plant, some companies are combining traditional data warehousing models with new data and digital platforms, such as edge and cloud computing. This approach can lower data-storage costs and enhance data-accessing speed.

Accelerator 3: Adopt an ecosystem mindset

When it comes to digital solutions, the whole is often greater than the sum of its parts. So think about building interconnected solutions on the same digital foundation. Internal ecosystems are key to this effort. Instead of developing standalone digital solutions that operate in siloes, combine them to create a multiplier effect.

A large copper mine in Chile combined a machine learning model for optimising copper recovery at the concentrator plant with its mineral tracking system at the mine. This combination enabled the company to adjust operating parameters according to different types of mineral clusters. This resulted in greater recovery yields that demonstrated the benefits of a truly integrated mine-to-plant optimisation.

Accelerator 4: Build digital talent

Most mining companies have adopted traditional operational improvement tools, such as Six Sigma and lean business principles. Now they need to add digital strategic thinking and upskilling to this toolbox, for all levels in the organisation.

At the senior leadership level, for instance, one mining company made arrangements for executives to visit digital centres and industry start-ups. They were able to see firsthand how digital technology was helping to solve the same kinds of problems their company was facing.

For middle managers, miners can build incentive structures that allow these managers to take measured risks and that give them time to show results. One company assigned managers to work closely with shop-floor teams to identify where digital solutions could solve business problems, and then to implement those solutions to become business as usual. The middle managers ended up feeling a strong sense of ownership of the digital transformation. That sense of ownership, in turn, improved the odds that adoption of the solutions, along with results gained from implementing those solutions, would be sustained.

For shop-floor teams, mining companies can show how digital tools solve real-world problems. Action Learning certification programmes that apply advanced digital tools to various business situations can help give trainees a common language to communicate with developers. Equally important, these programmes can encourage teams to adopt digital tools in their day-to-day jobs, further helping to ensure that the advantages gained from deploying digital will be sustained.

Accelerator 5: Apply digital tools across the organisation

Many mining companies have focused their digital efforts on improving operations, and they've generated impressive results from doing so. However, digital opportunities in operations are narrowing, as more and more companies invest in such initiatives. Consequently, the most forward-thinking miners are starting to apply digital to other functions, such as procurement.

Relying on manual or disparate systems for procurement can lead to stockouts, excess or incorrect inventory or delays in processing purchase orders. Digitising procurement processes can help miners avoid these problems. Many of BCG clients have moved to a QR-based ordering solution, which automates all the standard background processes and reduces the purchase order process to a single click. In more advanced applications, companies have deployed AI-based negotiation coaches to help purchase teams arrive at more favourable contract terms with vendors.

Finance is another case in point. Digital solutions are enabling finance officers to move away from spreadsheets and to improve financial planning. To illustrate, during the COVID-19 pandemic, managers have used these advanced tools to quickly model complex and multivariate scenarios related to factors such as demand recovery, commodity price movements and supply chain disruptions. These models have helped managers provide valuable inputs to leaders who are crafting business strategies as the pandemic has played out.

What industry leaders are saying

Next steps for miners

Mining companies fall on a wide digital spectrum, according to data from the DAI. Each company has adopted a different approach to digital, depending on its current state, business context and external environment. Still, much remains to be done in order for miners to close that digital strategy-execution gap--and thus to reap the full benefits on offer from digital.

Understanding and deploying the five accelerators above constitute excellent starting points for miners seeking to advance more speedily in their own digital journeys--while creating value that can be sustained long into the future (figure 2 above).

*Agustin Costa (costa.agustin@bcg.com) is a managing director and partner, Saurabh Harnathka (Harnathka.saurabh@bcg.com) is a principal, and Mikhail Volkov (Volkov.mikhail@bcg.com) is a managing director and partner, at BCG. This article is excerpted from "Racing toward a Digital Future in Mining," co-written with Amit Ganeriwalla and Nicole Voigt.

TOPICS:

RELATED ARTICLES

< PREVIOUS ARTICLE

Mick Davis' battery metals SPAC raises $300M

NEXT ARTICLE >

The greening of London's mid-cap miners

Get the Mining Journal Newsletter delivered free each day

FROM OUR PARTNERS

RESOURCE STOCKS

Northern Territory Copper Project Well Positioned

RESOURCE STOCKS

PolarX Strongly Backed by Gold Major