Project owners can relatively easily define the ‘what' of a project—by articulating its scope, cost and schedule. But answering the ‘how to execute' question hinges on smart decisions in numerous areas, including project delivery model. For example, miners must determine what work they can and should do, versus their contractors, who their partners should be, and how to organise them to deliver the work.

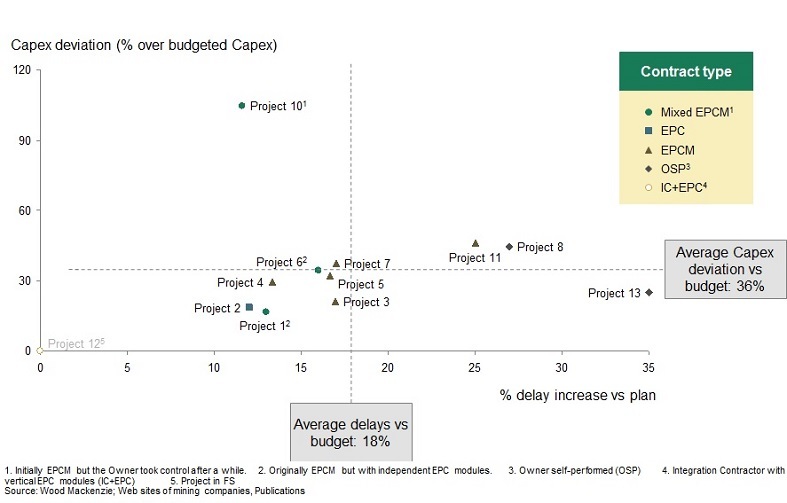

In the past, many miners opted for the owner self-perform (OSP) delivery model, managing all aspects of capital projects—including engineering design, procurement and construction. Preferences then shifted toward the engineering procurement and construction management (EPCM) model. In this model, the owner's team manages the program, but an EPC management company completes front-end design work and orchestrates the construction work. More recently, we've seen engineering procurement and construction (EPC) become a viable option for many mining projects with standardised designs or well-understood scopes. However, there's no one ‘right,' or ‘magic' model for all projects. Indeed, most mining capital projects experience delays and/or cost overruns, despite the delivery model used (see figure 1, below).

However, with EPC/M models, miners can gain some measure of control by tailoring the arrangement to their project's specific needs. For example, some may select multiple EPCMs or modify the contract so they have more input in contracting and procurement decisions. Savvy miners also know that successful execution is not all about choosing the least expensive option; human factors also powerfully influence project delivery. To illustrate, choosing providers that can work well together, adroitly manage project interfaces, and root costly complexities out of the execution process can greatly minimise project risks.

Through our client work and analysis of capital projects valued at more than US$1 billion, we've garnered valuable insights into how miners can successfully execute large-scale capital projects at a time of renewed growth and investment. Below, we offer five lessons drawn from these insights.

Stay true to your business objectives

Use the ‘why' of your major capital project—the business objectives you want to achieve—to guide your delivery model choices. The more specific, measurable, and clear your business objectives are, the more easily you can make decisions about trade-offs between success criteria, such as speed to market versus capital costs. Indeed, early in every execution-strategy engagement with a client, we encourage them to clarify their success criteria. Depending on their situation, such criteria might include better management of Capex versus Opex limitations, a specific level of quality of providers, and opportunities to innovate.

Know your team

Many mining projects experience delayed mobilisation because project owners lack a clear understanding of the skills available within their organisation. To avoid this problem, create a matrix mapping skills required for each role that a project entails. Use the matrix to assess your internal capacity and identify and address skills gaps, determine who should perform project work versus overseeing or governing a contractor, and gauge how many project interfaces will be tolerable. Also use your team's knowledge of the market and the commodity your company competes in to gauge the capability levels you'll need in your contractors. Let that assessment further inform your delivery model choices.

Know the provider market

There's no point in crafting a brilliant project delivery plan if there aren't enough providers out there capable of performing the work laid out in the plan. So, carefully assess the provider market. For instance, determine whether EPC/M firms you're considering have commodity-specific, local experience. If so, that can help you gauge how competitive the bidding will be on the work you want handled, and how competent the bidders are. By assessing the provider market, you uncover risks as well as opportunities. To illustrate, checking a provider's contract trends over time may reveal that a company isn't as strong in particular capabilities most important to you. Conversely, new local and global entrants may bring innovative approaches or ideas essential for your project.

Also consider construction contractors' size and experience, as well as how ‘hot' the labour market is. These factors all influence labour availability and contractors' risk tolerance. That, in turn, can inform your choices about contract structure options, such as cost-reimbursable contracts or fixed-price lump-sum packages, should you go down the EPC/M road.

Consider, too, whether you're looking to adopt new technologies (such as automated equipment) or innovative approaches (such as predictive maintenance through use of advanced analytics and artificial intelligence). If so, these changes may require new ways of working within your organization and with contractors. Finding contractors who can accommodate these changes and collaborate effectively with you and each other will be essential.

Plan for the long haul

During the boom, some major mining companies built strategic relationships with EPC/Ms. Even though the boom is over, such alliances (in particular, at certain phases of a project) can still have major value; for instance, by enabling miners to save money by consolidating management of projects in their portfolio. The lesson? Look beyond your immediate project to assess the kinds of relationships you want to establish with your contractors. One-off projects hint at a short-term transactional relationship. A pipeline of related projects suggests the need for a more enduring, strategic relationship with an EPC/M, in which incentives are aligned over a greater time period.

All too many project owners start off inking contracts with a narrow, transactional focus, which seems fine in the short term. But the agreement won't suit the project in the longer term if the owner's requirements changes. Fast-forward months or years down the road, and many projects have become embroiled in problems such as delays and claims leading to major cost overruns. In other cases, across a major capital program, each contract has to be renegotiated as agreements expire. That leads to costly and time-consuming duplication of effort, plus uncertainties in resource planning. As construction markets heat up, these issues only get worse.

How to avoid these scenarios? If you enter into framework agreements with EPC/Ms, take the opportunity to strike deals that provide a consistent structure and terms for future work, without necessarily adding specific commitments from you. And tie future work to key performance indicators (KPIs) on your current projects, thus aligning incentives.

Manage for performance

Regardless of the delivery model you select, always strive to influence your EPC/Ms' performance. Early on, define the KPIs you want to use, and determine how you'll identify and address any issues that do arise. This proactive stance always trumps reactive firefighting in controlling project cost, quality, and schedule. And because you've taken time to define what successful project delivery looks like, your reports to management will convey clear, meaningful updates about your projects. Additionally, use tools and techniques as needed to keep contractors and internal team members focused on achieving top-level project-execution performance. For example, ongoing workshops on critical-path reduction can help ensure on-time delivery of project work.

Executing large-scale capital projects in mining will always come with complexities, challenges, and risks. But miners that draw on insights gained from experience stand the best chance of making the right choices on crucial fronts such as project delivery model. As a result, they'll set their projects up for success—so their investments can start delivering the promised growth.

*Pierre-Yves Galopin (galopin.pierreyves@bcg.com) is an expert principal in BCG's Santiago office; Helen Quirke (quirke.helen@bcg.com) is a principal in the firm's Toronto office; and Warrick Lanagan (lanagan.warrick@bcg.com) is a partner and managing director in the Toronto office.