Sulfrian, who has just joined McEwen as the company's US exploration manager after more than 18 years at Barrick - mainly directing drill rigs at the gold giant's Nevada properties - told an investor and analyst day forum drilling at the company's Gold Bar property in Nevada in the first half of this year had expanded resources but also generated "information needed to develop high quality drill targets for the first time".

About 13,000m of RC drilling in and around existing operations at Gold Bar produced a number of solid drill intersections earlier this year. In all 79 drill holes for 16,000m of drilling was completed from the time of the last resource estimate in 2015, adding 92,000oz of indicated and 82,000oz of inferred resources, mostly in the Gold Pick and Gold Ridge areas.

The mine, south of Barrick's Cortez and Goldstrike mines that yielded 2.3 million ounces last year, is slated to produce 62,800oz a year at an average $770/oz cash operating cost for at least seven years.

But McEwen senior vice president exploration Sylvain Guerard said the new drilling and other work meant the company was now "entering a very interesting time for Gold Bar exploration".

"For the first time we have assembled all the key information that allows us to develop a robust geological understanding and define new high quality drill targets," he said.

"We are initiating drilling to target additional oxide mineralization to extend the mine life, and to explore for deeper Carlin-type gold discoveries."

Sulfrian said McEwen effectively restarted property-wide exploration after a five-year hiatus when it laboured through a particularly frustrating and drawn-out mine approval and development period.

"The lengthy permitting process delayed efforts to properly investigate the potential of Gold Bar," he said.

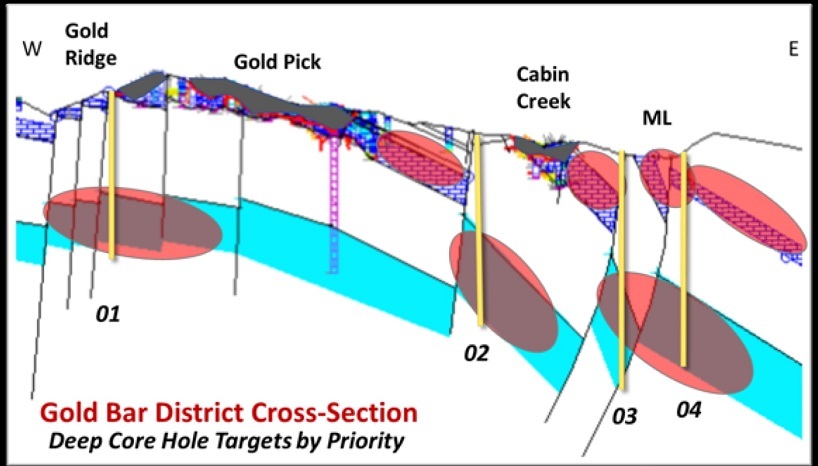

The new drilling had identified at least four high-priority targets for follow-up work - though the 10km-plus stretch underlying current and earlier openpits can't really be said to be a single target - and it is the potential at depth that most excites Sulfrian.

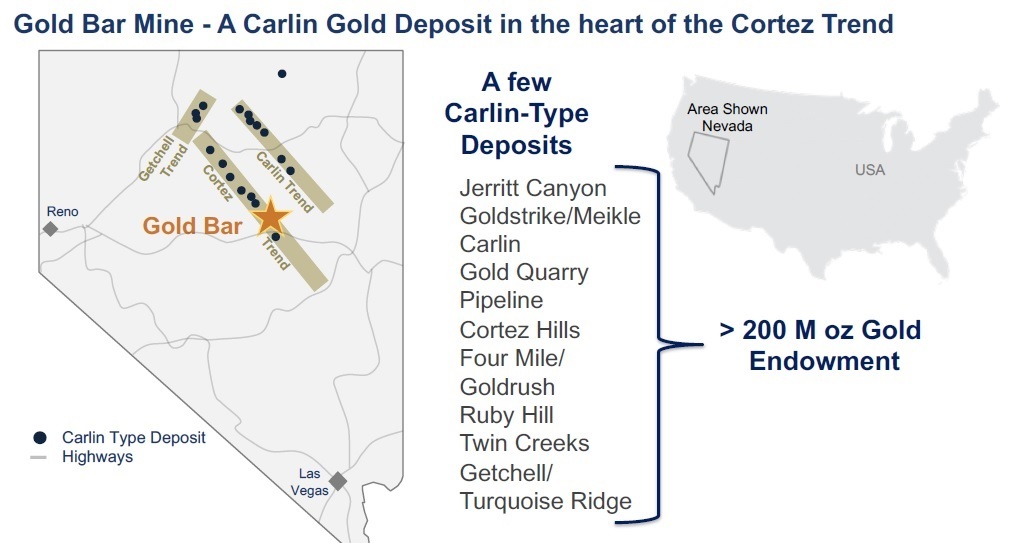

"Gold Bar is a Carlin-type gold deposit located in the heart of the Cortez Trend," he said.

Geochemical and geophysical surveys, mapping and drilling results had all highlighted similarities in terms of host rocks, alteration and mineralisation styles, proximity to intrusions and stratigraphic horizons, with other deposits along the same trend.

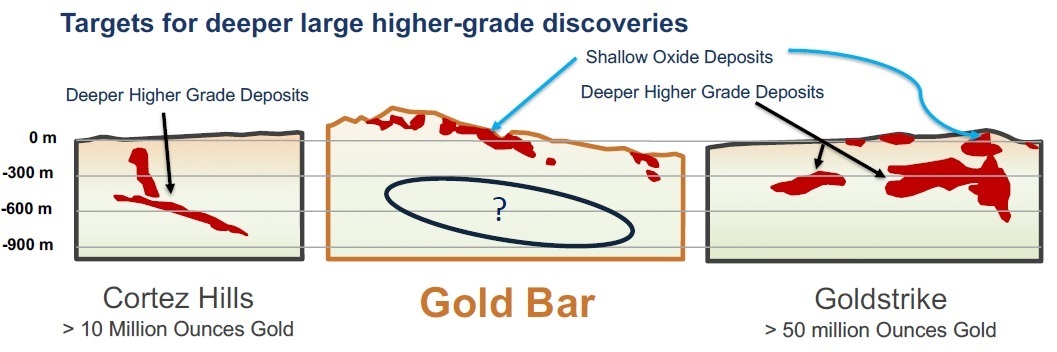

"Deeper, higher-grade deposits are typical of Carlin systems," Sulfrian said.

"They are the most exciting to me personally, having worked at Goldstrike mine with Barrick for more than 18 years. The deep targets [at Gold Bar] combine for over 10km of strike length of untested area, underlying some of our shallow oxide deposits."

A property cross-section showing four deep targets to be drilled this fall (section below) showed how mineralisation might occur at depth, Sulfrian said.

"Two fellows I currently work with at McEwen [who] I used to work with at Goldstrike saw this slide and the first thing they said was, that looks like Goldstrike. We have the same situation with shallow oxide deposits and down dip potential, as well as these lower units. They wondered if I just copied an old [Goldstrike] section."

McEwen has budgeted for at least 3,000m of core drilling and 5,000m of RC in its current program.

Successful exploration, and particularly in the sulphides below oxide deposits sustaining current heap leach operations, "may hold the key to Gold Bar becoming a world class deposit", Sulfrian said.

McEwen is also prioritising three near-surface target areas that are all considered to have potential to expand resources and/or open up new resource areas.

The company's founder, chief and major shareholder Rob McEwen, who also established gold major Goldcorp in a previous life, told the meeting recent exploration success at the company's key operations and projects in Canada, Mexico, Argentina and the US was welcome, but made prioritising exploration funding difficult in the current environment, where the company was working to reduce its costs, improve its margins and cash flow, and also maintain development spending.

"We are a big believer in exploration and that it can create enormous value," he said.

Exploration in Timmins, Ontario, and Nevada shaped as the big value drivers for the company, but it also had its capital commitments elsewhere.

The company's US$74 million fundraising last year, it's first in five years, to enable the acquisition of Black Fox in Ontario and completion of Gold Bar, also boosted working capital.

"There will be times when we have to go back into the market to raise additional funds if we want to keep the exploration rate running at a high rate in Timmins, in Nevada, in Mexico, and doing some of the infrastructure spending at Los Azules," McEwen said.

"One fly in the ointment right now is Argentina has imposed an export tax, so it's going to cut back some of the revenue from our San Jose mine down there.

"But we're seeing all these [exploration and development] opportunities and I'd say we're just going to play it by ear.

"I'm excited by Timmins, which reminds me a lot of the early days at Red Lake when I was building Goldcorp, but also want to go after some of the deep targets in Nevada.

"Historically we have always been exploring there for shallow oxide deposits that can be processed by heap leach. Today we have some deep sulphide exploration targets where we will be hunting for elephants [and] the larger Carlin-style mineralisation."