Over the past three months China's central bank is reported to have bought 32 tonnes of gold, lifting its holding to 1,874t with purchases of around 10t a month believed to be continuing, helping keep the gold price around US$1,300 an ounce.

Apart from shifting some of its financial reserves away the US dollar, a currency China fears could fall sharply in the future as US Government debt rises, there is a desire to limit exposure to a country with which it is locked in a trade war.

Gold neatly meets China's need for a safe home for some of its savings because it is an asset class unencumbered by government debt.

But gold also stands out in the broader commodity sector as a material which has performed strongly over a long time, rising by around 125% over the past 56 years, an increase achieved relative to income growth and adjusted for inflation.

Credit for that interesting calculation goes to the Australian stockbroking firm of Bell Potter which used data and reports assembled by the US-based think tank, HumanProgress, an organisation founded by the Cato Institute with support from the John Templeton Foundation.

In the latest edition of a Bell Potter research report called Bells Gold Tracker the performance of gold over the 56 years from 1960 to 2016 is remarkable, partly because the starting point was a time when the official gold price was pegged at $35/oz (and stayed there until 1971) and partly because of gold's natural appeal as a currency and commodity hedge.

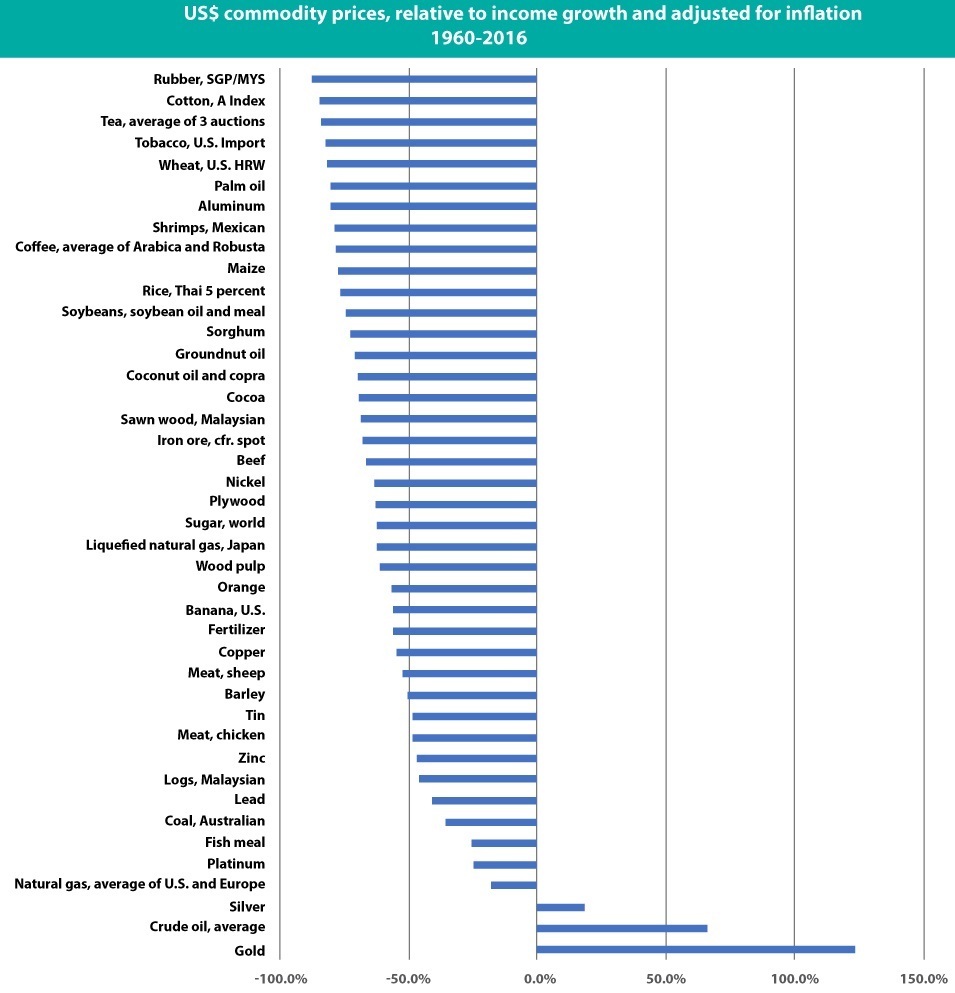

In the latest edition of its Gold Tracker, Bell Potter, uses HumanProgress data to compare the financial performance of 42 commodities up to 2016 with the first surprise being that only three (7%) delivered a positive return after allowing for inflation and income growth.

After gold's 125% rise came crude oil which rose by around 60%, with that result also affected by a significant event, the Arab oil embargoes of the 1970s, and silver, which rose by about 30%.

After that it was all downhill for the commodities tracked with natural gas in Europe, platinum, fish meal and Australian coal the best of the commodities in negative territory, down by between 10% and 40% once inflation and income growth are accounted for.

At the bottom of the tree (or the top if you're looking at the table), with a startling price fall in real terms of around 90%, was rubber, followed by cotton, tea and tobacco.

Other metals assessed by HumanProgress and Bell Potter included aluminium (down according to the published table by about 70%), iron ore (down 60%), nickel (down 55%), copper (down 52%), tin (down 48%), and zinc (down 46%).

Bell Potter said the commodities price chart illustrated "the long-lived investment appeal of gold as a store of value and a safe haven currency unencumbered by government debt".

China's newly-developed gold-buying habit is a prime example of a government forming the same view, committing an estimated $80 billion of its whopping $3 trillion in foreign exchange reserves to gold.

In percentage terms, China's gold exposure is a modest 3%, well short of the gold-buying by another country which has firmed in its dislike of the US and the US dollar, Russia, which has an estimated 19% of its reserves in gold.

Both China and Russia, partly through their own buying, which is putting a peg in the gold price, can expect their investment choice to continue to perform well - or, at least that's the view of a big US investment bank, Morgan Stanley. In its latest gold report, the bank noted the development of some downside risk to the gold price, but added that falling US interest rates and a weaker US dollar "still support the case for upside."

"Our foreign exchange strategists maintain their view that the US dollar will weaken from the third quarter of this year, as fiscal policies are maxed out," Morgan Stanley said.

"Continued buying by central banks is a further moderate price support with purchases totalling 126 tonnes in the first quarter of the year as China, Russia and Turkey further added to their gold reserves."

Morgan Stanley believes current risks are weighted to a weakening of the gold price as trade tensions ease, the global economy picks up and a delay to Brexit shifts investors to risker assets.

"Further ahead though a weakening of the US dollar, falling real interest rates and rising inflation all remain bullish medium-term factors that will drive a recovery in the gold price in the second half of the year to around $1,350/oz," the bank said.