Nickel is a vital component of the key next generation batteries including nickel-manganese-cobalt (NMC) batteries used in electronic vehicles and nickel-cobalt-aluminium (NCA) batteries, which are being adopted in electronic vehicles and grid storage.

Nickel's role as the 'silent' member of the battery metals family is borne out in its strong recent upward price trajectory and a bullish outlook.

Nickel started 2017 fetching around US$10,000 per tonne before reaching a recent high approaching US$16,000 per tonne, in April this year.

Industry major Vale predicts nickel demand in the electronic vehicle market to reach 36,000 tonnes in the current year, and then balloon to 350,000-to-500,000t by 2025.

With demand for electronic vehicles and other applications of new battery technologies set to boom over the coming decades, the outlook for nickel seems assured.

And this is without considering the prime use of quality nickel, which is in the production of stainless steel. Currently 78% of the world's nickel is consumed by the stainless steel industry.

While market dynamics are driving positive sentiment for nickel, at the same time Corazon Mining (ASX: CZN) has continued to make positive strides at its Lynn Lake nickel sulphide project in the central Canadian Province of Manitoba.

"We have long viewed the Lynn Lake Project as a potentially highly significant nickel sulphide development opportunity," explains Corazon managing director Brett Smith.

"Our focus has been on advancing the project to a point where it is ‘development-ready' at a time when there is a strong price environment for nickel, which would make the project a particularly attractive development proposition."

For Corazon and the Lynn Lake project, that time may be rapidly approaching.

In October, the company announced a major mineral resource upgrade at the project, which delivered an increase of more than 60% in total tonnes and a 35% increase in nickel and copper metal (from the company's previous resource statement released in 2015).

Corazon managing director Brett Smith: "We see an opportunity to apply up to date, modern processing technologies, which we expect to achieve substantial benefits in metal recoveries and product quality"

In addition cobalt was included in the Lynn Lake resource estimate for the first time, which adds significant further value to the resource.

The new resource is 15.3Mt grading 0.72% nickel, 0.34% copper, 0.034% cobalt (indicated and inferred, at a 0.5% Ni cut-off), for total contained metal of 110,400t nickel, 51,400t copper, and 5,200t cobalt.

"There is little doubt we are in the midst of a large mineralised sulphide system at the Fraser Lake Complex"

The upgraded resource also includes a high-grade resource estimate of 5.2Mt grading 1% nickel, 0.41% copper, 0.044% cobalt (indicated and inferred, 0.7% nickel cut-off).

In addition, Smith points out the resource is of a very high quality and is well supported by drilling and historical mining data.

"We anticipate that the majority of the defined tonnages will be easily upgradeable to the higher measured JORC category, with only a small amount of additional verification drilling and sampling required to achieve this," he says.

Of further interest is the fact that the new Lynn Lake Resource was calculated from only five deposits - the EL, N, O, P and Disco deposits. The project hosts an additional 11 deposits plus multiple other drill-defined areas of mineralisation that have yet to be included in resource studies. These areas support the potential for further substantial upgrades to Lynn Lake's mineral resource.

In parallel with the resource work, Corazon is currently undertaking a detailed metallurgical test work program at the project.

"The commencement of metallurgical test work at Lynn Lake is an important step in the project's development pathway," Smith says.

"Previous processing technology utilised at the project for the extraction of nickel, copper and cobalt was developed in the 1950s and 1960s, and no detailed test work has been completed at Lynn Lake in more than 40 years.

"We see an opportunity to apply up to date, modern processing technologies, which we expect to achieve substantial benefits in metal recoveries and product quality, and in turn deliver significant reductions in both operating and capital costs for any future mining operation at Lynn Lake."

A 500kg bulk sample of Lynn Lake mineralisation has been shipped to ALS Metallurgy in Perth to facilitate the test work, which will focus on ore characterisation, flotation and product definition for down-stream processing.

It is designed to provide key data for future mining and development studies centred around a potential re-commencement of mining at Lynn Lake.

"This represents exciting times for the project," Smith says.

"Once completed, the results of the metallurgical test work, along with the new resource estimate, will be utilised in mining and development studies for Lynn Lake, designed to provide preferred developing and processing pathways for the project and we expect these studies to be finalised in early 2019."

Lynn Lake is one of Canada's largest nickel producing regions, having mined in the order of 22.2 million tons at 1% nickel and 0.5% copper between 1953 and 1976, when mining ceased due to depressed nickel prices.

Corazon completed the acquisition of the entire Lynn Lake nickel-copper sulphide field in 2015 - the first time this world-scale nickel belt has been controlled by one company since the mine closure.

In addition to its development focus around the Lynn Lake Mining Centre, the company has also systematically explored the wider project area. This work has resulted in the definition of a stand-out target, at the Fraser Lake Complex, 5km south of the Lynn Lake Mining Centre.

Corazon has high-quality nickel sulphide exploration targets at Lynn Lake and the nearby Fraser Lake Complex … "The exploration potential at the area cannot be understated"

"We are targeting new, large Lynn Lake-style nickel sulphide discoveries at the Fraser Lake Complex, and the exploration potential at the area cannot be understated - we believe this area has the potential to deliver a new, world class nickel sulphide discovery," enthuses Smith.

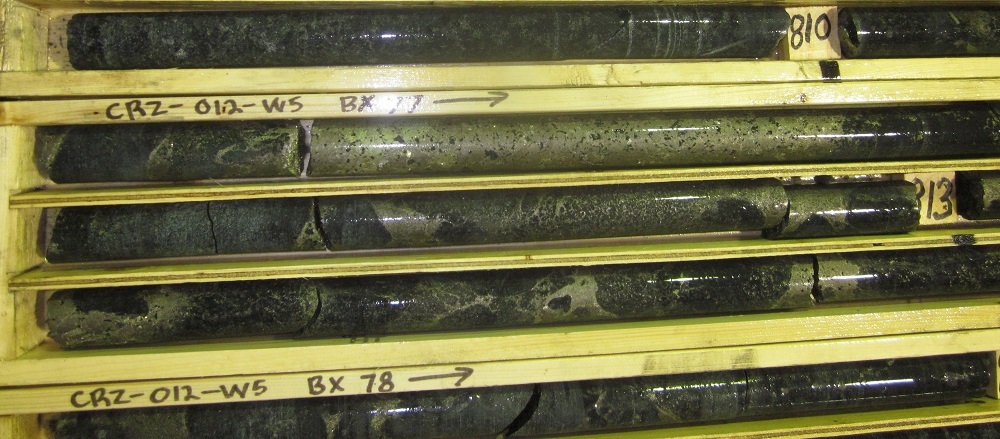

Corazon has undertaken extensive geophysical and geochemical targeting work and has completed four phases of drilling at Fraser Lake.

This has resulted in the discovery of a large magmatic sulphide system with the potential to host significant nickel-copper sulphide deposits.

"There is little doubt we are in the midst of a large mineralised sulphide system at the Fraser Lake Complex," Smith says.

"A large number of holes in our drilling programs have been extensively mineralised for the entire length-of-hole and nickel and copper-bearing sulphides are observed throughout the drill core."

The combination of Corazon's ongoing development plans for the Lynn Lake Project and the undoubted exploration potential of the Fraser Lake Complex, coupled with a bullish outlook for nickel, sees the company well placed to become a significant player in the listed nickel space.

ABOUT THIS COMPANY

Corazon Mining

HEAD OFFICE: Level 3, 33 Ord Street, West Perth, Western Australia 6005

Telephone: +61 (8) 6166 6361

Email: info@corazon.com.au

Web: www.corazon.com.au

DIRECTORS: Terry Sreeter, Brett Smith, Jonathan Downes, Mark Yumin Qiu

QUOTED SHARES ON ISSUE: 1,265 million

MARKET CAP (at $0.059 per share): A$9.43 million

MAJOR SHAREHOLDERS: Hanking Australia Investments ~5.00%