For instance, can their blast furnace take on ore with higher silica content without cost implications? What level of phosphorus is optimal for reusing slag from their LD convertors? Such trade-offs open up an array of specification combinations that customers can choose from.

The sum total of any combination's impacts on a mining company's business and a customer's downstream processes is called value-in-use (ViU). Miners that understand ViU and that maximise it for their customers can sharpen their competitive edge.

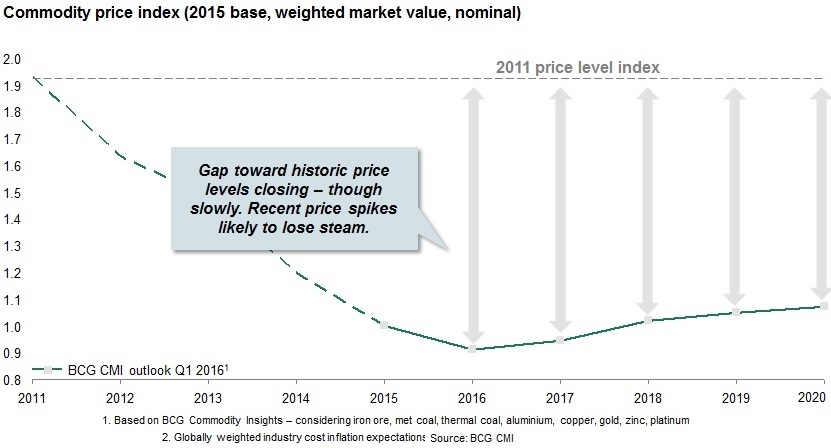

Before 2010, quickly scaling up their capacity was a priority for many miners. But since then, falling commodity prices have eroded miners' profitability. Though the recent uptick in prices has been encouraging, prices globally won't likely reach pre-2010 levels soon. And they'll probably remain highly volatile, making it difficult for miners to sustain any benefits gained from price peaks (figure 1, below).

Yet ore-transportation costs have also fallen, and that has given miners access to new markets. Charter rates, for instance, have plummeted nearly 70% since 2010. Consequently, entry barriers for competition have come down, and all players can remain cost competitive even while selling to distant customers.

To succeed in this new business landscape, miners have increasingly concentrated on boosting productivity and lowering costs. Most companies have tackled the simplest, most readily achievable improvements first—such as cutting overhead costs or mining high-grade zones in their existing operations. Others have taken further steps, such as driving equipment efficiency, labour productivity, and other improvements to derive maximum value from their operations. As a result, unit production costs have declined and stabilised overall. Yet this also indicates that the traditional levers have started running out of steam, renewing miners' vulnerability to the vagaries of global commodity prices. Today, miners who excel at playing the ViU game will stand the best chance of shielding themselves from those risks.

The advent of digital technologies can help them. Correctly used, digital can transform how companies go about their operations. For example, miners can now use advanced sensors to track ore-quality parameters at every processing step, and automation to change and control those parameters. Big data analytics can help them identify how ambient factors affect quality. Such advancements have opened up new avenues for mining companies to use their digital capabilities to maximise ViU for their customers.

Mining companies can benefit in multiple ways from using a ViU approach:

• Differentiated positioning: Miners can develop products customised to specific customer needs and thus differentiate themselves in a commoditized market and charge premium prices. Note, though, that the extent of customisation is limited by ore body availability and a plant's process regime. For instance, a plant may have higher alkali ore to LD convertors.

• Customer loyalty: ViU can help miners strengthen their relationships with customers, because defining and creating ViU for a product requires close collaboration with customers. By understanding customers' downstream processes and requirements, miners can tweak their processes and technologies as needed to meet those requirements. Rivals vying for the same customers can't easily replicate this level of service.

• Market-risk mitigation: ViU enables miners to base their prices on the value created for each customer. A high-ViU product can't be readily substituted by commodities available in the market, because it is specifically designed to create value in a particular customer's downstream processes. This product differentiation can protect miners from market-price volatility.

Delivering maximum ViU

To deliver maximum ViU to customers, miners must drive value across the entire gamut of processes—from the mine to customers' downstream processes to the end product. Mining companies can do so by meeting three imperatives:

• Reduce customers' costs: A key objective of ViU is to reduce customers' end-to-end costs. Most ViU initiatives involve process changes in mining that may drive up ore cost. However, ore cost can be offset by reducing downstream process costs. For instance, reducing the percentage of phosphorus in ore requires additional mining and processing costs but leads to an overall savings by increasing slag reusability.

• Improve customers' productivity: Productivity improvement in downstream processes helps customers boost their output without having to expand capacity, and dilutes fixed costs in those processes. These benefits can offset any additional costs required in the ore-beneficiation process.

• Ensure the desired end-product quality: Any variation in ore quality leads to costly deviation in customers' downstream processes. Miners that align their supply chains to deliver a differentiated product while minimising quality deviations create greater ViU benefits for customers.

Embedding ViU in the organisation

To meet these imperatives, miners need to embed ViU in their organisation. Integrating the ViU agenda into their improvement processes is a good start. Almost all ViU benefits originate from calibrating mining-process parameters to match customers' changing quality requirements. To achieve this match, miners should let customers' requirements determine how they design their mining processes and develop agile processes that can adapt to changing market and business dynamics.

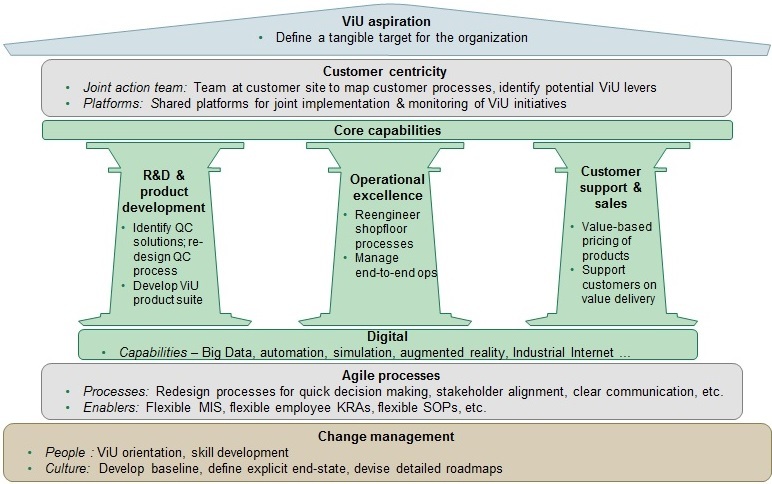

And since ViU requires a new business model, miners need to foster the right mindset to make the model successful. Our work with clients shows that miners can take the following steps to foster a ViU mindset in their organisation (figure 2, below):

• Articulate the ViU aspiration: Define tangible targets for your company's ViU projects. Targets can describe benefits to your company (such as revenue increases or greater pricing power) and to customers (such as lower costs and higher productivity).

• Promote customer-centricity: Closely study your customers' downstream processes and work with customers to identify opportunities to increase ViU for them. Remember that any change in ore-quality parameters will affect the end product. So, set up joint technology teams and shared platforms for identifying ViU opportunities and closely monitoring ViU initiatives' impact.

• Develop core capabilities: Take steps to strengthen key functional capabilities in your organisation—such as R&D, product development, operational excellence, and customer support. Develop digital capabilities, too, including Big Data analytics, automation, simulation modelling, augmented reality, and the Industrial Internet. To acquire or strengthen needed capabilities, combine hiring specialised personnel with training existing workers.

• Create agile processes: To quickly adapt to changes in market forces and business dynamics, cultivate fast decision-making at the top. Align internal stakeholders behind the ViU vision by modifying KRAs and SOPs as needed. Fast-track approval processes, develop a flexible MIS system, and clearly communicate new mandates to the shop floor.

• Manage change: ViU projects require a collaborative culture and ongoing reexamination of commonly accepted practices. So don't forget to manage the human side of change. For example, creating cross-functional platforms that take full ownership of ViU projects is crucial.

Despite widespread awareness of ViU, this approach remains considerably underutilised in the mining industry. Miners that take a fresh look at ViU and integrate it into their business model can set the stage for capturing lion's share of its potential - before rivals do.

*Amit Ganeriwalla (ganeriwalla.amit@bcg.com) is a partner and director in BCG's Mumbai office; Sachin Kotak (kotak.sachin@bcg.com) is a partner and director at BCG's Delhi office; Dilip Kumar (kumar.dilip@bcg.com) is a project leader in BCG's Delhi office; and Mayukh Ghosh (ghosh.mayukh@bcg.com) is a consultant at BCG's Delhi office.