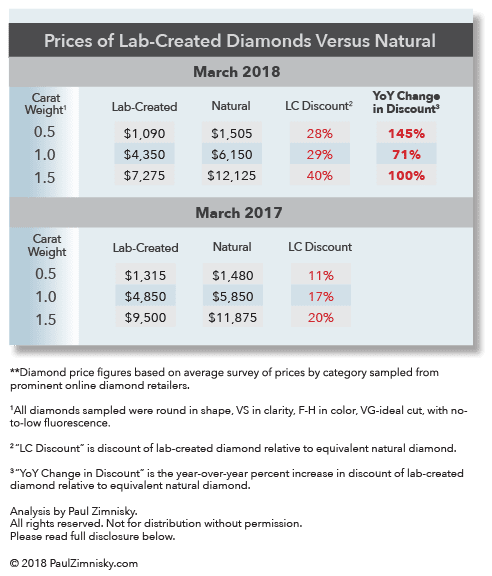

A white, one-carat round diamond that is very-slightly included in clarity, F-H (near-colourless to colourless) in colour, VG-ideal cut, with no-to-low fluorescence was selling for approximately US$4,850 in March 2017. A year later, it is going for $4,350, a 10% decline.

However, over the same time period, the price of an equivalent natural diamond went from $5,850 to $6,150, a 5% increase. Thus, the discount of the lab-created diamond relative to the natural equivalent has gone from approximately 17% in March 2017, to about 29% now. This is a 71% year-on-year increase.

Lab-created diamonds are becoming less expensive relative to natural equivalents as investment in lab-diamond production technology has rapidly improved production economics in the past few years. This has led to rapid relative supply growth and an environment that is more price competitive for lab-diamond manufacturers.

However, actually gauging lab-diamond supply growth is difficult. The global proliferation of lab-diamond production facilities in recent years, from China to Russia to the US, has made it challenging to track production figures, especially given the companies involved are private and proprietary in nature. Further complicating the process is the range in quality and scale at which lab-diamonds are produced.

Natural diamond production quality can be segmented as approximately 40% gem-quality, 20% near-gem-quality, and 40% industrial-grade. Gem-diamonds are used in jewellery, industrial-grade diamonds are used for abrasive and other industrial applications, and near-gem diamonds are used for both jewellery and more-specialised industrial applications, with the split of use dependent on market prices and demand.

It is important to note natural industrial-grade diamonds are simply seen as a by-product, as the presence of gem-quality diamonds in a deposit are what drives the economics behind natural diamond production decisions.

In the case of lab-diamonds, the ability to create higher-quality gem-diamond products economically is a relatively recent development - within the last decade.

Even with the recent developments in technology, current lab-created production of true gem-diamonds represents less than 10% of global output, estimated at less than 5 million carats. This compares with natural gem-quality output of circa-60Mct (based on 40% of an estimated total natural production of 147M carats in

2018).

The business of manufacturing lab-created diamonds for industrial applications (typically referred to as synthetic diamonds) has been around for decades, and the industry currently supplies more than 99% of global industrial diamond supply for use as abrasives (production is in the billions-of-carats for context).

Lab-production of near-gem-quality diamonds is where supply analysis gets especially challenging. Producers of synthetic industrial-quality diamonds have been advancing their production capabilities through improved technology that has enabled them to increase the quality of their product from industrial to near-gem quality. Given that billions-of-carats of industrial-quality diamonds are produced each year, it becomes apparent that lab-created near-gem production could be in the hundreds-of-millions of carats, and some of this product is being passed off for use in jewellery - primarily used to embellish larger-stones and for use in pavé settings.

The natural diamond industry has been proactively developing affordable screening technology so lab-created diamonds of all quality and sizes used in jewellery can be properly disclosed and sold as such.

As lab-diamond production continues to accelerate, it seems inevitable the price spread between lab-created and natural diamonds across all sizes and qualities will continue to widen, especially in the case of generic lab-diamonds, those that are not supported by a manufacturer or retailer's brand.

Medium-to-longer-term, the dialogue surrounding lab-created diamonds is expected to shift from jewellery to applications in high-tech developments such as processing chips, optics, laser devices, and thermal conductivity equipment. The unique properties of diamonds makes their application potential exciting and wide, and the scientific and tech community has just begun to scratch the surface of this potential.

The high-tech industry enthusiastically awaits economically available, mass-produced high-quality diamonds, the lab-diamond manufacturers know this and most are just using jewellery as a stepping stone.

Paul Zimnisky is an independent diamond industry analyst, author of the Zimnisky Global Rough Diamond Price Index and publisher of the subscription-based State of The Diamond Market monthly industry report. Paul can be reached at paul@paulzimnisky.com and followed on Twitter @paulzimnisky