The ASX junior (DAV) has been working diligently with a leading consulting firm to refocus wider attention on the credentials of Germany's South Harz potash basin, and its potential to be a bigger factor in future supply of the valuable agricultural mineral in the region and wider market.

It has also just appointed UK-based Bacchus Capital Advisors to help it fully harness the increasing interest from European investors in its plans to develop a significant potash business in the basin.

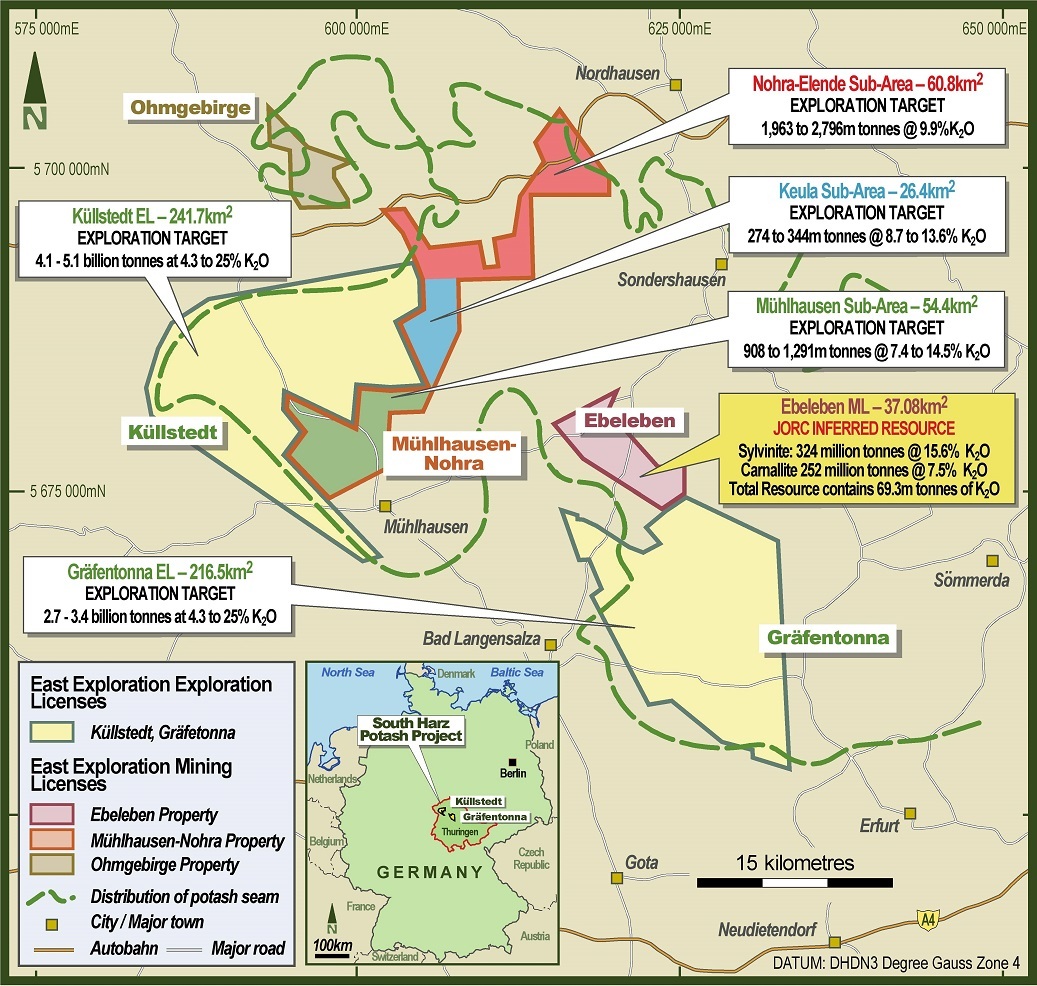

Davenport's three perpetual mining licences and two exploration licences cover 659sq.km of a region described as a "cradle of potash mining" from which more than 180 million tonnes of potash has been extracted since the 1890s. Historic drilling and Soviet-era mining in the basin indicates the licences are underlain by a continuous potash horizon and renowned UK-based expert in the conversion of Soviet-era Resources into JORC 2012-compliant resources, Micon International, helped Davenport post a maiden JORC resource for the central Ebeleben licence earlier this year.

The licences acquired by DAV were extensively explored in Germany's pre-unification era and substantial historical resources were previously calculated under the old German Democratic Republic (GDR) system. Micon reviewed 31 historical drill holes on the 100%-owned Ebeleben licence to come up with the impressive JORC 2012 inferred resource of 576.6 million tonnes at 12.1% potassium oxide (K20), containing 69.3Mt of K20.

Davenport last year acquired the Ebeleben, Mühlhausen-Nohra, and Ohmgebirge mining licences in the South Harz region, to add to its Küllstedt and Gräfentonna exploration licences in the area. The new licences are perpetual mining licences granted under the former GDR system, and notably not subject to expiry, rent, royalties, or reporting requirements of the current German tenure system.

The region has a history of producing potash from sylvinite and carnallitite ores and produced about 3.3Mt of K2O) annually prior to the re-unification of Germany. Potash ores were historically mined by both conventional underground and solution mining operations.

"While Ebeleben is one of our smallest areas, Micon has confirmed a significant resource that compares closely to both the historic resource and the recently-announced exploration target," says Davenport managing director Dr Chris Gilchrist, a 35-year mining industry veteran with mine management and director level experience who has built and managed large mines in Europe and Africa, and who has significant experience in potash mining, processing and marketing.

Gilchrist worked at Danakali, Circum and Cleveland Potash. Jason Wilkinson, Davenport's project director, is another with significant potash experience. His 25 years in exploration included seven years at Allana Potash and as in-country manager for Israel Chemicals in Ethiopia, taking its project from start-up to feasibility.

"This is the first of several areas in the recently acquired licences where we believe there is sufficient data to support the conversion of historic resources into mineral resources as defined by the JORC Code," Gilchrist says.

"We are working to bring the other licences to a similar level recognised by the JORC Code and, if their exploration targets are also realised, these areas will represent Europe's largest declared potash resource."

On a simple enterprise metric, Davenport's current market value compares pretty favourably with a bunch of its peers who are further along the potash development road, such as Danakali, Sirius Minerals, Highfield Resources and Kore Potash.

There is an expectation that the grades in the South Harz will continue to be revealed to be significantly better than those at other advancing projects. Offsetting this will be the deeper nature of the potash in the basin, which has traditionally been mined by underground methods.

Scoping level numbers for Davenport could be revealed early in 2019.

A capital intensity of less than $1,000 per annual tonne of production for any project is seen as required, with the idea being to start modestly and expand organically.

Gilchrist says established regional mining and general infrastructure could favourably impact capex, while the basin's proximity to European markets is obviously advantageous.

"We're in a safe jurisdiction - in a mining friendly region - so there is no country risk."

The South Harz resources also contain sulphatic minerals such as polyhalite and kieserite and the potential for multi-nutrient fertiliser production, in addition to MOP, is seen as being "very high".

Meanwhile, more JORC resource announcements could be just around the corner.

The extensive mining and exploration history in the area means the geology of Davenport's project area, and characteristics of the potash mineralisation in the area, are reasonably well known. An evaporite sequence containing the potash seams in the South Harz area occur at a depth of between 500m and 1,000m below surface. The overlying rocks consist of a marine sequence of sandstones, mudstones, marl, dolomite and siltstones.

Within Davenport's Küllstedt licence potash mineralisation is hosted by the Permian Stassfurt Formation which ranges in thickness between 32m and 255m. Within the Stassfurt Formation the Kaliflöz Stassfurt unit contains the potash seam which underlies the entire Küllstedt licence area. The potash unit is up to 58m thick, and appears to be richer in Carnallite potash mineral in the north and Sylvite potash mineral in the south. The base of the Stassfurt Formation is a dolomite unit that has been of interest to hydrocarbon explorers in the past.

Past mining and exploration within the Küllstedt licence has included three vertical shafts which operated up to 1924 - which have been excised from the tenement - as well as potash exploration drill holes and oil wells that have drilled through the potash formations.

Geological data and some assay data for the drill holes has been used to develop a 3D geological model of the potash seam. An Exploration Target for potash within the licence is 4,055Mt-5,141Mt with a grade range of 4.3% K2O to 25% K2O.

Davenport says less geological information is available on the Gräfentonna licence but the stratigraphy is broadly similar to Küllstedt. Based on preliminary data there appears to be a sylvinite-dominated seam running down the central part of the license area and carnallitite-dominated seam towards the eastern side of the licence. Gräfentonna has on it a current Exploration Target of 2,678-3,396Mt at 4.3%-25% K2O.

Davenport has been working with the regional mining authority to get approval to start drilling at the Küllstedt licence with a view to twinning existing exploration holes that intersected potash, to help update the resource. Drilling is expected to start early next year.

"The quality of data collected from Ebeleben and Mühlhausen-Nohra over several drilling campaigns dating back to the 1970s gives us confidence that we will soon be able to declare JORC-compliant inferred resources for all of our perpetual mining licence areas," Gilchrist says.

"To achieve this with minimal further drilling will be a tremendous boost to Davenport's plans to return the South Harz Basin to its former glory as one of the main potash-producing regions of the world.

"It will clearly reduce development time, and costs, significantly."

Potash is being described as the slow burn success story of the commodity markets.

Major growth market India is set to import around 4.5 million tonnes of MOP (muriate of potash, or potassium chloride) and, closer to home, the European market continues to grow at a consistent rate. With the imminent scheduled closure of K&S's Sigmundshall potash operation in Germany, Davenport could find itself sitting on Europe's biggest potash resource and in a strong supply position in the heart of Europe.

"Potash of course has an increasingly important role in meeting the challenge of feeding the world's growing population," says Gilchrist.

"It's a critical ingredient in plant fertilisers used to improve crop production yields by improving a plant's retention of water, nutrient value, taste, colour, and resistance to diseases and pests. The world's population is growing at 80 million a year and is headed to 9.3 billion by 2050, and arable land per person is rapidly shrinking so fertiliser is essential to increase global farm output.

"We see the potash market slowly emerging from a period of oversupply with demand growing at around 3% a year.

"It is expected to exceed 65 million tonnes this year.

"The MOP Price at about US$260-280 per tonne is strengthening as inventories are reducing and the market returns to balance.

"So it's a good time to develop a project."

ABOUT THIS COMPANY

Davenport Resources

HEAD OFFICE:

- L28, 303 Collins St, Melbourne, Victoria 3147, Australia

- Phone: +61 0415 065 280

- Web: davenportresources.com.au/

DIRECTORS:

- Patrick McManus

- Dr Chris Gilchrist

- Christopher Bain

- Rory Luff

QUOTED SHARES ON ISSUE:

- 139.28 million

MARKET CAP (at September 6, 2018):

- A$9.47 million

MAJOR SHAREHOLDERS (as at September 2018):

- Parkway Minerals (25.9%)

- Lufgan Nominees Pty Ltd and Associates (10.4%)

- Rory Luff (8.2%)