In the January 2020 issue of this journal, experts from BCG's Metals & Mining practice and the BCG Center for Climate Action introduced and provided an overview of a framework developed by BCG that helps mining companies address climate change.

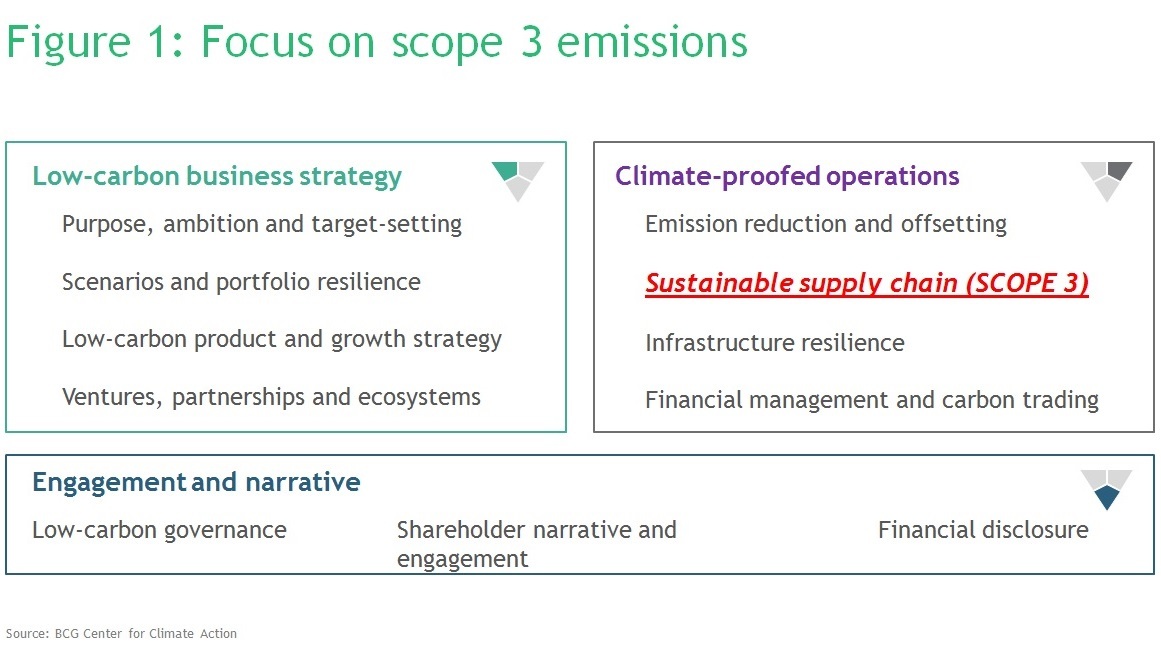

As noted in that article, smart responses to climate change comprise three main pillars: a low-carbon business strategy, climate-proofed operations, and effective engagement of key stakeholders in the effort to combat anthropogenic global warming's impacts.

Here, we focus on achieving sustainability in the mining supply chain—a crucial task in climate-proofing a company's operations (figure 1, below). In mining, supply chain sustainability hinges on savvy management of scope 3 greenhouse-gas (GHG) emissions.

Why care about scope 3 emissions?

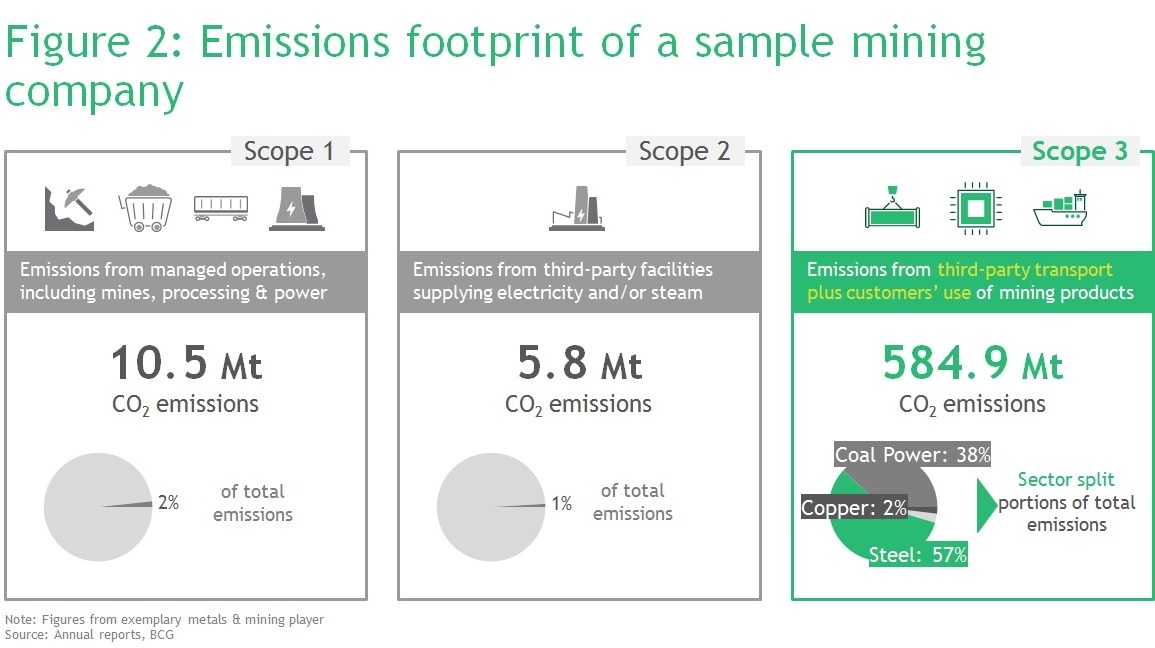

Why should miners care about reducing scope 3 GHG emissions, especially if they're already managing emissions from their own operations? The answer is simple. When we look at a typical mining company's total emissions footprint, scope 3 emissions often constitute more than 90% of that footprint. Additionally, as part of disclosure requirements, miners must include data on their scope 3 emissions.

Equally important, addressing downstream emissions is equivalent to protecting mining companies' core business. As their customers modify their operations to reduce their own emissions, these changes could boost or erode demand for miners' products. For instance, if steel manufacturers switch to lower-carbon production routes, demand for scrap steel could increase, while demand for primary inputs such as iron ore and metallurgical coal could decrease. Miners heavily invested in metallurgical coal and iron ore who don't help their steel customers reduce emissions risk becoming the next thermal coal has-beens.

Addressing downstream emissions is equivalent to protecting mining companies' core business

Miners that work with their customers to reduce their downstream carbon footprint craft a truly holistic response to climate change risk. As a result, they improve their odds of safeguarding their core business—while also enjoying higher valuation multiples, building more resilient portfolios and gaining greater access to investment funding as well as talent seeking companies committed to sustainability.

Spotlight on steel

When it comes to mitigating scope 3 emissions, collaborating with customers in steelmaking may arguably present the greatest opportunity for miners to help drive towards a carbon-neutral future. Consider that steel is everywhere in our lives, playing a central role in economies around the world. But the steel industry's contribution to global direct emissions (7-9%, according to WorldSteel) is twice the industry's contribution to global gross domestic product—even when considering total added value along the value chain (3.8%, according to WorldSteel).

Moreover, steelmakers' own scope 1 emissions (from operations such as ironmaking, steelmaking, casting and hot and cold rolling) are formidable; a typical integrated producer of 5 million tonnes of hot rolled steel equivalent per year emits 9 million-plus tonnes of CO2 per year. Finally, steel is the main driver of scope 3 emissions across many players in the mining industry; in particular, miners of iron ore and metallurgical coal (figure 2, below).

Like miners, steel manufacturers have come under mounting pressure from multiple directions to develop an effective response to climate change risks. For example:

• Regulations. The EU carbon neutrality commitment by 2050 will require all EU steel manufacturers to reduce their emissions, and may affect regulations on all manufacturers selling into Europe (for example, through a carbon border tax). Additionally, changes laid out in Phase IV of the European Union's Emissions Trading System (ETS) aim to correct earlier inefficiencies in the scheme. The ETS will likely force a steeper pace of annual emissions cuts in covered sectors, including steel. Changes include, for example, annually adjusting emissions allocations to reflect current production levels, reducing the overall number of free emissions allowances and using new funding mechanisms to enable a transition to lower-carbon operations.

• Investors. The Global Investor Coalition on Climate Change, a network of 250-plus institutional investors representing over US$30 trillion in assets, defined expectations for the steel sector to take action in the face of climate change. And BlackRock, the world's largest asset manager with almost $7 trillion in investments, announced it will immediately stop investing in companies that "present a high sustainability-related risk."

• Customers. Steel customers are increasing demand for clean products, joining programmes such as the Responsible Steel Initiative to enhance transparency into their raw-materials supply chain. Early signs indicate that metals producers can selectively extract a ‘sustainability' premium (such as aluminium players including Alcoa, Rusal and Norsk Hydro offering lower-carbon alternatives). In a recent survey of end customers in 27 EU member states, managed by the European Commission, 80% of participants said they'd be willing to pay a premium for ‘green' products.

The power of partnerships

Forward-thinking steelmakers are already taking action to reduce their GHG emissions. For instance, they're adopting technologies including:

• Smart Carbon Usage (SCU) through process integration with reduced use of carbon (such as HISARNA, TGR-BF, PEM and STEPWISE)

• Carbon Valorisation or Carbon Capture and Usage (CCUS) using CO/CO2 from the steel mill as raw material used in other industries (such as Steelanol, Carbon2Chem and FreSMe)

• Carbon Direct Avoidance (CDA) using renewable electricity instead of carbon in basic steelmaking (such as HYBRIT, SuSteel, H2Future, H2morrow, GrinHy, MACOR/SALCOS and SIDERWIN)

Deploying such technologies successfully requires cross-sector partnerships. Consider H2morrow. This partnership intends to create a blue H2 production and CO2-capture mechanism. Members include thyssenkrupp, Germany's largest steel plant, which aims to decarbonise steel production; Equinor, a Norwegian supplier planning to provide blue H2 from reformed natural gas, and operating a storage facility for carbon capture and offshore storage; and Open Grid Europe, the continent's leading gas-transmission system, which intends to feed the H2 through its network. A joint feasibility study on this effort was launched in 2019.

Meanwhile, the Steelanol collaboration is developing a CO2-capture and recycling technology. Members include steel company ArcelorMittal, which coordinates the project as well as operates and maintains the demonstration plant; Primetals, responsible for engineering, automation, key equipment and commissioning; LanzaTech, which developed the technology that's being used; and E4tech, which is designing a lifecycle assessment for Steelanol fuel, based on data from ArcelorMittal's plant in Ghent. The first commercial-scale unit is being set up at Ghent, and five more sites may be rolled out for ArcelorMittal in the EU by 2026.

Time for mining companies to step up

Clearly, leading steelmakers are willing and able to work with players at multiple points within their ecosystems to tackle climate-change risks. And the innovations they're catalysing demonstrate that progress is possible.

Mining companies thus have a vital opportunity to participate in such partnerships to mitigate their scope 3 emissions. Several progressive miners have already stepped up in this way. Take HYBRIT. This cross-sector joint venture comprises Swedish mining company LKAB, Nordic and US-based steel company SSAB and Swedish multinational power company Vattenfall. It aims to create a hydrogen-based steelmaking process in northern Sweden by 2035 that uses no coal and emits no carbon dioxide.

BHP, Australia's biggest miner, intends to become the first in the world to set goals for its customers to cut GHG emissions, making an ambitious carbon pledge aimed at not just steel mills but also shippers and power plants. BHP's plan includes a $500 million initiative focussed on tackling its own emissions along with those generated by customers using its products, including coal and iron ore. BHP plans to set public goals for its customers' emissions footprint during the first half of 2020.

Another Australian mining leader, Rio Tinto, recently signed a memorandum of understanding (MoU) with China's Baowu Steel Group and Tsinghua University to find ways to decrease carbon emissions throughout steel's value chain. Each party in the MoU will analyse how it can best deploy its unique strengths—research, technology, business processes, equipment—to combat the impacts of climate change in the steel industry. Since 2008, Rio Tinto has reduced its own carbon footprint by 30%.

Mining companies' efforts to partner with steel manufacturers to reduce scope 3 emissions are in the early stages. However, momentum in this direction may be building. For instance, seven leading mining and metals companies have joined with the World Economic Forum to develop blockchain solutions for accelerating responsible sourcing and sustainability practices—including carbon emissions tracking and supply chain transparency between upstream and downstream partners.

Such moves constitute crucial steps in the path toward combating climate change. Miners that advance the farthest and fastest along this path will take the lead in demonstrating a commitment to decarbonisation.

*Nicole Voigt (voigt.nicole@bcg.com) is a managing director and partner at BCG: Jens Burchardt (burchardt.jen@bcg.com) is an associate director at BCG; Ingo Mergelkamp (Mergelkamp.ingo@bcg.com) is a senior knowledge expert at BCG; Dharani Nalabolu (Nalabolu.dharani@bcg.com) is also a senior knowledge analyst at BCG; and Caitlin Baker (Baker.caitlin@bcg.com) is a project leader at BCG