Sierra Leone's promise as a mining destination is unquestionable, but fortune has not been in the country's favour in recent years.

A landslide killed 1,000 people in the capital Freetown last year, Ebola struck in 2014 as the country was still only a decade removed from civil war, and when the bottom came out of the iron ore price, two of the country's five operating mines at the time shut down.

NMA Director General Sahr Wonday: "We want to try to make sure that the investor gets a good return on the investment but also as a country we benefit from our mineral wealth"

But the country's mining industry will soon take a major step forward in the form of countrywide, reliable and accessible geophysical data. The airborne survey will kick off later this year and start delivering results in mid-2019, likely bringing more explorers and allowing current players in the country to make sure they're getting the most out of their land packages.

There are still relatively few public companies with a Sierra Leone project as their principal offering, but between ASXlisted Iluka Resources and explorers coming in, investors will have more and more options to get into the rising jurisdiction.

The new government of His Excellency President Brigadier (Rtd) Julius Maada Bio, who was elected in April, has made several positive steps already for prospective investors. In his first speech to parliament after taking office, President Bio was open about the challenges facing miners and his new government in Sierra Leone, outlining the hit to the country's growth rate (down from 6.3% in 2016 to 3.5% in 2017) when operations shut down.

President Bio has also been clear about his goals for rejuvenating investment in the sector.

"My government has committed itself to create the right environment to convince investors to take that great leap to invest in a sector that is already under siege and in a continent renowned for its unpredictability," he said.

"An environment where international investors can be confident that they will have the support of government to navigate the pitfalls and take advantage of opportunities for creativity and innovation."

The seriousness of this approach was shown by the cancellation of 40 exploration licences which the National Minerals Agency decided were not likely to be developed.

Those cancelled licences represent an immediate opportunity for serious investors, but there will also be significant amounts of geological data arriving next year for those willing to wait for the World Bank-backed airborne survey and mapping project.

The government says it will promote the new data around the world at mining conferences, confident in the survey's power to attract foreign explorers.

Sierra Leone has had to look on while neighbouring countries developed a name in the resources industry - Cote d'Ivoire has plenty of big players exploring; Liberia has overcome Ebola and now hosts a continually improving gold mine in New Liberty; and, Guinea is moving along with a bauxite mine and refinery, even as Simandou remains stalled.

Geology: what we know so far

The current insight into Sierra Leone's geology comes from broadbrush estimates, projectspecific exploration, artisanal operations and historic surveys.

The British Geological Survey wrote a frank analysis of the situation after a visit earlier this year.

"Sierra Leone is a resourcerich country, with extensive known and potential mineral and petroleum resources," the BGS team wrote.

"However, knowledge about the geology of the country is limited, with very little modern data in the public domain, and this hinders sustainable development of these resources for the national good."

As Sierra Leone has long been a producer of gold, diamonds and iron ore, geologists are in the unusual position of being able to find promising orebodies by looking at where artisanal and some industrial miners are already exploiting deposits.

Geoscientist Dr Kelvin Anderson, a lecturer at the geology department of Fourah Bay College in Freetown, said the country's known kimberlite pipes are only in the east but there had to be more.

"Even though diamonds have been found in the north and south, we only know of diamondiferous kimberlites in the eastern side of the country," he said.

"When I was working for Stellar Diamonds, we did some exploration in the south … and there was so much that was indicative of kimberlites, but no diamondiferous kimberlites. Kimberlite has been found down in the south, but it is not diamondiferous.

"[Artisanals] are mining diamonds down there, so there must be kimberlites that are not yet discovered."

Dr Anderson, who has consulted on the airborne survey, said there would also likely be extensions of the greenstone belt.

"We know that the gold is in the greenstone belt, but the greenstone belt has not been mapped in detail," he said.

"We have the main greenstone belt, but we know gold is also found in the north."

African Battery Metals (ABM, formerly Sula Iron & Gold) has found plenty of gold in the north.

Its most recent drill results from the Sanama Hill area of the Ferensola project in September 2017 delivered intercepts of 19.3 g/t Au over 1.2m and 8.6 g/t Au over 2m, as part of a 5,000m drilling programme.

ABM is looking a for joint-venture or farmout partner for the project.

The director of Sierra Leone's Geological Survey, Prince Cuffey, said the airborne survey could also turn up new metals for the country.

"From historic data that we have, there is a copper anomaly somewhere in northern Sierra Leone," he said. "There is potential for nickel and cobalt [as well]."

The airborne magnetic and radiometric survey will cover the whole country at 150m line spacing and an EM survey (with 200m line spacing) will focus on the Sula-Kangari greenstone belts, the kimberlite zones, and the Nimini and Gori Hills greenstone belts.

This move has been helped along by the World Bank, which has put in US$20 million in funding.

The mapping phase itself will also be incredibly important for bringing more explorers into the country.

The BGS said it would be a big step up from the currently available data.

"Most work on natural resources in Sierra Leone depends upon the 1:250,000 national geological map of Sierra Leone," the BGS team wrote.

"This map is now often treated as being accurate, despite the fact that it has clear shortcomings."

Dr Kelvin FE Anderson

Dr Kelvin Anderson (pictured above) is a geoscientist with over 15 years' experience, having worked as a geologist and geophysicist in diverse operating environments in West and Central Africa, including Sierra Leone. He has led prospecting teams that have explored remote areas of this region for diamonds, gold and iron ore. Dr Anderson recently served as National Consultant for two countrywide projects in Sierra Leone, that is, for GeoFocus (Pty) South Africa, who were contracted to chart and prepare the groundwork and design for a successful airborne geophysical survey, and for the Environmental Protection Agency, where he was responsible for all geological and technical aspects of the Artisanal and Small-scale Gold Mining Overview. He also has a university professional career, having worked as a lecturer in the Department of Geology, Fourah Bay College, University of Sierra Leone. He holds a master's degree in Geo-Information Science and Earth Observation, with specialisation in Applied Geophysics, from ITC, University of Twente, Holland, and a PhD in Earth Resources from Camborne School of Mines (CSM), University of Exeter, UK.

|

Current operations

The assessments of the current geological knowledge might indicate there is very little going on in the Sierra Leone mining industry, but that's nowhere near the case.

National Minerals Agency data from 2017 shows 6.5 million tonnes of iron ore, 277,000 carats of diamonds, 1.8Mt of bauxite and 222,000t of ilmenite and rutile were produced in Sierra Leone.

Iron ore numbers have dived since Shandong Steel and Iron shut down its Tonkolili operations last year.

Diamond numbers should be up this year as the BSG Resources-owned Koidu is back in production after a move underground.

The Koidu head of technical services, Miles Van Eeden, said the project had reached throughput of 80,000 tonnes per month after 15 months of downtime during the transition.

The move to sub-level caving caused some consternation locally, but moving to a new mining method has prolonged the operation, which has been in production since the early 2000s.

"Going underground has been a learning curve for the company itself as well as for the country, because we had to embark on a whole new environmental impact assessment and participation workshops," Van Eeden said.

The company's community work has long been a feature of the operation; during the Ebola crisis, Van Eeden and his colleagues were faced with the choice of staying or leaving and shutting the mine down.

"I think it was in our best interests in the company to stay open and operate normally," he said.

Sierra Leone's National Minerals Agency is working closely with the country's government on delivery of a fairer royalty system - part of a platform that shows the public the industry is providing public as well as corporate benefits

"If [the mine] closed down the entire community would have fallen apart.

"From a social community point of view as well, all factors considered, we decided to put systems in place so that it would be a going concern."

The rewards are clear in the region.

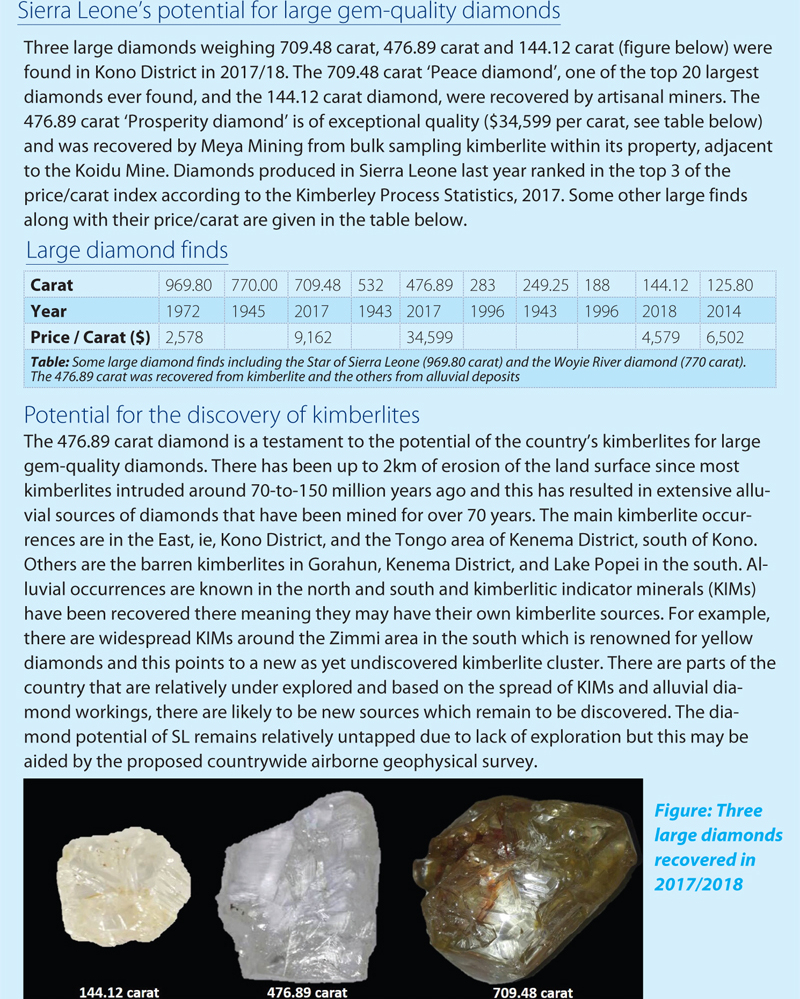

The neighbouring Meya Mining operation sold a 476-carat rough stone to Laurence Graff for $16.5 million at the end of 2017. It wasn't the first big diamond found in the area: the Star of Sierra Leone was also from nearby, and is the fourth-largest gem-quality stone ever found at 969ct.

Looking at the county's bulk mineral production, rutile has been a consistent performer, with Sierra Rutile now part of Iluka Resources.

Following this acquisition in 2016 Iluka has boosted its cash flow and reduced its debt considerably on the back of improved market conditions for mineral sands.

At Sierra Rutile, the company is currently doubling the capacity of the Lanti and Gangama dry mines from 500-600t per hour to 1,000-1,200tph by 2019. This is part of a large expansion programme which will see safety and sustainability upgrades made at existing operations and also consider the Sembehun project, which is currently the subject of a definitive feasibility study.

Iron ore has had a trickier time in recent years; price weakness and demand for higher-grade ore led to Shandong shutting Tonkolili.

Nearby Marampa was also hit by the price fall resulting in the collapse of its owner. New licence and rights were issued and awarded to the former offtaker of the mine Gerald Metals, which plans to start producing again by the end of the year.

Craig Dean is head of Gerald and its subsidiary SL Mining. He said Marampa would come back into production at a good time. "By the end of the year, we should commission and put the mine back into production for 2Mtpa of high-grade concentrate with greater than 65% Fe content," he said. "We're fortunate because the resource is quite good."

Getting permission

The government of Sierra Leone made several bold moves this year in the mining sector.

The cancellation of the 40 licences, freezing mineral lease agreements (MLA) handed out by the previous government, and closing the permitting process for new players are a few of the actions taken so far.

NMA Director General Sahr Wonday said these were necessary steps to get the industry back on track.

"What we're going to be looking at is trying to align [the MLAs] with international best practice," he said.

"We want to look at how much of that cake is divided - how much goes to the shareholders, how much goes to the central government, how much goes to the local communities - because depending on how you tweak the permits, then it will shift one way or the other.

"We want to try to make sure that the investor gets a good return on the investment, but also as a country we benefit from our mineral wealth."

Wonday, who worked for Sierra Rutile for more than 30 years, said communities in mining areas also needed to better understand the industry.

"How we strike that balance is going to be the challenge. Because the perception out here in Sierra Leone is that the public is not benefiting much from our mineral wealth and it's all going to the investors, and so on. That's the general public perception," he said.

"I'm not saying that's necessarily the case, but we need to provide supportive evidence to show the country is actually getting a fair share of the wealth that is created by this investment and then that will go a long way towards addressing those public concerns."

On top of the MLA work, the government has already brought in a new extractive industry act, in line with getting mining companies onto a single, transparent tax arrangement.

Wonday said bulks would have a royalty rate of 3% under the act.

The legislation has set the rate for diamonds worth more than $500,000 at 8% and those worth less will have a rate of 6.5%. Precious metals are listed with a royalty rate of 5%.

Navigating the new rules

SL Mining received its MLA at the end of the last year, and while all MLAs are being reviewed by the new government, Craig Dean said he has confidence to move forward with bringing the mine back into production and investing as much as $300 million "as we have good government support and completed all formalities in accordance with applicable law".

"Elections happened in March, there were some meetings we went through in April and May, and after we had the first official meetings, we got comfort right away and said let's pull the trigger," he said.

"Where we are now, I do feel we got very good support. The bottom line is if you get the mine up and running, it creates jobs."

Marampa will likely be employing around 1,000 locals by the end of the year.

Dr Anderson from Fourah Bay College said the government crackdown on those sitting on licences was very positive.

"With those licences cancelled, this is the appropriate time to come in and look at what's been cancelled," he said.

Reflecting on the current industrial-scale operations in the country, Dr Anderson said production did not match the resource profile.

"It's a bit weird we don't have any gold mines in Sierra Leone," he said.

"We need investors in the gold industry to come and help with the artisanal workings."

New gold prospects should come as the airborne survey results roll in.

Craig said Gerald Metals would be watching keenly.

"It goes without saying that with the size of investment we're putting in the country we would be highly interested in being able to work, explore and exploit more within Sierra Leone," he said.

"I know [the government is] going through a campaign now and pulling permits, so I'd say they are trying to crack down and legitimise things a bit more, which is a good thing."

Dr Anderson said one critical piece of work as the airborne survey got underway would be the geodata management system currently before cabinet.

"The data would grant immense power and knowledge to whoever is going to be in control of it," he said.

"They should give people equal access … a system wherein some government official would not have access to the data and start doing deals with people, who come and take over the most prospective areas."

Sierra Leone has previous experience in using policy to change the industry for the better. The Kimberley Process led to more diamonds being sold through official channels, according to Dr Anderson, who also studied artisanal mining intensively.

"Our investigation shows us that most of the gold is being smuggled into Guinea," he said. "From the diamond side, it's a completely different story thanks to the Kimberley Process.

"That has forced even the artisanal miners to bring their diamonds to the government for export."

Anglo American subsidiary De Beers is also trying out a technology-backed solution called ‘GemFair', which involves supplying artisanal miners with tablets and tamperproof bags.

They log their finds through an app, and then the diamonds' supply chain journey can be tracked all the way to the boutiques of London or Hong Kong.

Prospectivity to prosperity

There is still a long way to go for Sierra Leone's mining industry.

But with the support of institutions such as the World Bank, Adam Smith International and the British Geological Survey, along with beefed up membership of the Extractive Industries Transparency Initiative, the country should be able to move quickly towards a mining sector based on largescale, sustainable operations.

The skills base is there at the management level, with a strong geology tradition (seen in people like Dr Anderson and Prince Cuffey), and industry experience coupled with policy expertise (Wonday) working under a leader keen to change things, this is a positive time for the country.

Mining can bring major developmental changes to poverty-stricken countries if the right processes are in place, as shown in a recent International Council on Mining and Metals report.

It's now up to the Sierra Leone government to follow through on its big ideas and allow miners to turn some of that mineral promise into prosperity.

ABOUT THIS COMPANY

Sierra Leone

- A country rich in natural resources

- Iron-ore mining operations have resumed

- Diamond production ongoing from three kimberlite pipes

- Primary gold exploration at an advanced stage

HEAD OFFICE:

- Address: NMA Headquarter, New England Ville, Freetown

- Phone: 00232-79-250702

- Email: info@nma.gov.sl

- Web: www.nma.gov.sl/