RESOURCEStocks: Incredibly busy and successful start to the year for you, and some big milestones coming up including delivery of the Sconi nickel-cobalt-scandium project BFS in Q2 and start-up of the demonstration processing plant. Firstly, what is the latest on completion and delivery of the processing plant and is everything on budget/schedule?

Benjamin Bell: The past six months has been a company-making period for us, having attracted a large amount interest from some of the world's largest investment houses to raise $20 million in an oversubscribed share placement to fast-track our project development activities, as well as further advancing our positive engagement with interested parties regarding off-take and project financing, culminating in February with signing of a landmark agreement with SK Innovation for the expected cobalt and nickel production from the Sconi project.

Australian Mines has been working with consultant Simulus Laboratories to complete critical path work on the demonstration-size processing plant in Perth in the past three months, including the delivery and installation of the crucial autoclave component, which allowed commissioning of the plant to be completed in February and the commencement of processing operations to start in March. The demonstration plant completion schedule was delayed slightly due to certification of components being carried out in the United States in line with that country's more onerous engineering and quality assurance standards, however the plant was delivered very close to the indicated budget.

RS: How is trial mining progressing at Sconi/what are you aiming to get out of the exercise other than ore for the demo plant?

BB: The trial mining campaign at Sconi was completed in the September quarter, with ore mined and transported to Perth to support our initial processing run of 30 tonnes through the demonstration-size processing plant, which is expected to produce up to 1,000 kilograms of battery grade nickel sulphate, 120kg of commercial grade cobalt sulphate and at least 10kg of high-purity scandium oxide.

Our chief operating officer Tim Maclean has been leading the commissioning and processing operation with the demonstration-size plant, which in addition to providing commercially saleable samples of our product suite to potential off-take partners, has allowed us to significantly de-risk the project through proof of concept using a proven, industry standard processing flow chart that has been independently verified by engineers from SK Innovation.

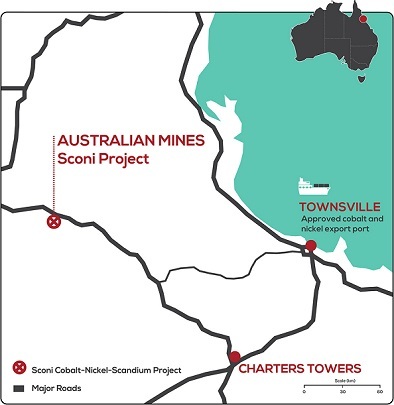

The trial mining campaign itself also verified, using just light earthmoving equipment, how amendable the mineralisation at Sconi is to simple and scalable free-dig mining methods via relatively shallow open pit operations even when at full scale. The ultimate benefit of trial mining in-situ ore at Sconi and taking that through a scalable commercial processing facility to deliver battery grade cobalt and nickel products is to provide a greater level of certainty to our off-take and potential financing partners that we can physical deliver what the Bankable Feasibility Study contemplates from a laterite deposit, which we are very comfortable with.

RS: On the cobalt sulphate, nickel sulphate and scandium oxide samples to be produced for verification by SKI, when do you anticipated dispatching the first samples/when will you get feedback on specs?

BB: We are on track to deliver commercial grade cobalt sulphate and nickel sulphate samples to SK Innovation in April for verification, along with separate samples to parties potentially interested in the scandium oxide off-take from the project, not currently committed under the current off-take agreement.

SK Innovation has confirmed Sconi ore specification for cobalt and nickel sulphate as being compatible with typical battery cell and cathode specifications. We will hand deliver 20kg of cobalt sulphate and 160kg of nickel sulphate to SK Innovation in April and expect any further feedback well ahead of the completion of the BFS scheduled for June. However, it is worth noting that the off-take agreement is not conditional on delivery of samples.

RS: You highlighted at the recent Explorers Conference in Fremantle the gap in value the market is putting on your advanced project, and Clean Teq/Sunrise, a gap that's moreorless similar now. What are you putting that down to/how is it going to change?

BB: The market value gap between us with our Sconi Project and the market favourite in the Australian cobalt-nickel-scandium project space, being Clean TeQ with Sunrise, is a function of the market alone and the fact they have a very high-profile chairman who has a significant global investment following and a track record for building large scale resources projects.

We have significantly grown our market capitalisation in the past 12 months through consistently delivering on stated exploration and development milestones. However, the value gap to Clean TeQ certainly does not reflect Sconi position as the most advanced project of its type in Australia, with all approvals in place and a commercial agreement for 100% of production of the battery commodities.

RS: Where are you aiming to position Sconi on the world cost curve for cobalt producers, with the other metal credits?

BB: We significantly progressed work on calculating CAPEX and OPEX numbers for Sconi in the December and March quarters, but the final cost numbers to build and operate the project will not be finalised until the BFS in completed in June, as we are currently undertaking an optimisation review on the proposed mining and processing operation with input from SK Innovation to ensure the project is set up right to efficiently and consistently deliver into our binding sale and purchase contracts.

The good news on that front is that SK Innovation is committed to assist in the development, construction and/or financing of the cobalt-nickel-scandium processing plant at Sconi subject to the outcome of the BFS and we have engaged Medea Capital in UK to continue to assist with the project financing process, including discussions with international banks and bond issuing companies

RS: What will be the revenue split, at current prices, for the project's planned output?

BB: At the moment the price that will be paid by SK Innovation under out agreement for the cobalt and nickel is based on LME price (adjusted for sulphate premium and/or impurities in the product), with the priced fixed for three months based on the average trading price for cobalt and nickel for the preceding quarter.

Recent LME cobalt price has been comfortably above US$80,000 per tonne, while current average LME price for nickel is sitting at around US$13,500 per tonne. We expect our cobalt sulphate to contain approximately 20% cobalt metal equivalent and the nickel sulphate to contain about 21% nickel metal equivalent.

At those prices and product specification, I expect revenue split for fully-ramped up production from Sconi of up to 12,000 tonnes of cobalt sulphate and up to 60,000t of nickel sulphate to be roughly 55% and 45%, respectively. The project economics being considered as part of the BFS do not bank on revenue from the co-production of scandium, but obviously any commercial production and sale of that commodity will boost revenue from Sconi.

RS: AUZ is due to start resource expansion drilling "with multiple rigs" at Flemington this month. Can you just provide an outline of that work, the main focus areas, and key aims?

BB: The opportunity remains for us to significantly increase the mineral resource inventory at our secondary Flemington Project in New South Wales, with the current mineral resource area covering a fraction of the interpreted prospective host geology within the large tenement package.

Given the current strength of Australian Mines balance sheet, the company plans to commence a significant resource expansion drilling program in March, pending landholder approval, incorporating multiple rigs ahead of a pre-feasibility study in the second half of 2018.

In the interim, we have also commenced a regional field mapping and sampling campaign over the broader Flemington/Fifield district, with the objective of being in a stronger position to prepare a JORC-compliant exploration target for Flemington to provide shareholder guidance on the potential size (both grade and tonnage) of the mineral resource that we may expect to ultimately achieve at the project.

ABOUT THIS COMPANY

Australian Mines Limited

HEAD OFFICE:

- Level 1, 83 Havelock St, West Perth, Australia 6005

- PH: +61 8 9481 5811; FAX: +61 8 9481 5611

- EMAIL: office@australianmines.com.au

- WEB: www.australianmines.com.au

DIRECTORS:

- Michael Ramsden,

- Benjamin Bell,

- Mick Elias,

- Dominic Marinelli,

- Neil Warburton

QUOTED SHARES ON ISSUE:

- 2.14 billion

MAJOR SHAREHOLDERS:

- BNP Paribas Nominees 4.65%;

- Pershing Australia Nominees 4.02%;

- Citicorp Nominees 3.81%;

- HSBC Custody Nominees 3.12%