Executives from some of the world's largest mining companies revealed their attitudes and strategies for growth in a new Mining IQ report.

Leadership Insights 2025 (available here) features interviews with 17 large (>US$1.5 billion market cap) mining companies on the theme of unlocking growth, plus findings of a survey completed by more than 180 professionals from across the industry.

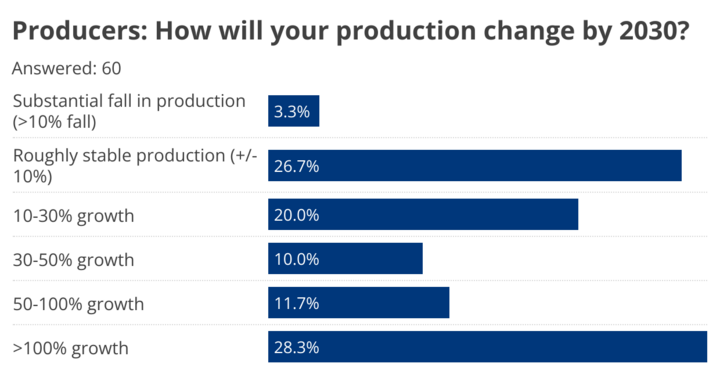

The report highlights production growth as a top industry priority, with more than a quarter of producers (28.3%) surveyed planning to double output by 2030. The executives interviewed outlined growth projects expected to deliver more than 4 Mozpa of gold and 1.2 Mtpa of copper over the coming years (the list was not comprehensive).

The following quotes give a flavour of the Leadership Insights 2025 findings, touching on key topics analysed in the report. These include a focus on quality over quantity and organic over inorganic growth, the biggest threats to growth (topped by permitting and regulatory challenges), a lack of exploration spending and the role of technology in future production.

Top 10 quotes: Growth milestones

- "Our growth strategy is firmly rooted in organic expansion. Since the merger with Randgold Resources, we have added 111 million gold equivalent ounces of reserves at an average cost of just US$10 per ounce – well below typical acquisition costs."

Barrick Mining chief executive Mark Bristow shows the benefits of organic over inorganic growth. About two-thirds (65.1%) of mining and exploration companies surveyed said their main focus was organic growth.

- "Over the last 20 years, we've gone from one to 11 mines, from one to four countries, and from 240,000 ozpa gold to 3.4 Mozpa, but what really matters are the numbers on a per-share basis – that's how we measure success."

Agnico Eagle Mines CEO Amma Al-Joundi summarises the company's path to becoming a top gold producer but says shareholder value – rather than volume – is king.

Disciplined approach

- "The biggest challenge to growth is being disciplined. The history in the gold space has been one of undisciplined growth, of growing for the sake of growing."

Lundin Gold CEO Ron Hochstein underlines a shift away from the ‘growth for growth's sake' attitude that burned investors in the last gold bull market.

- "We don't have a growth strategy; we would be just as happy not to grow if that creates more value."

Boliden CEO Mikael Staffas takes a tough line on value over volume growth.

Top threats to growth

- "We continue to see volatility in the global macro-economic drivers and, of course, this volatility makes the development of the long-term investments that characterise our industry a more challenging proposition. At the same time, the increasing capital intensity of new supply means that the mining sector will struggle to produce the metals and minerals the world so desperately needs, at current prices.

"This is compounded by a landscape where it is increasingly challenging to find new economic orebodies, secure permits within reasonable timeframes, and where societal expectations continue to increase – with good reason."

Anglo American CEO Duncan Wanblad gives an overview of the array of challenges the mining industry faces in delivering growth, from price volatility to societal expectations.

Top threats: permitting

- "Globally, it takes an average of 16 years to start operation. For some operations, the number of permits can run into the thousands. Research also shows that lead times are getting longer. This process needs to be simplified, but not at the expense of the environment or society."

Antofagasta CEO Iván Arriagada calls for a simplification of permitting processes. Regulations and permitting challenges pose the biggest threat to growth, according to the survey.

- "On average, mines take over a decade to go from discovery to production, and a large part of that timeline is the length of the permitting process. Governments are increasingly understanding this and are working to streamline permitting in many jurisdictions. This is why we are so excited about the Fast-track process in New Zealand."

OceanaGold senior VP, business development and investor relations, Brian Martin, gives a welcome example of government efforts to streamline permitting, which is expected to speed up approvals for the company's Waihi North project.

Lack of exploration

- "For many larger mining companies, it's easier to acquire existing deposits and operating mines than it is to discover and build. However, that doesn't grow our industry. Over time, those deposits are depleted, and if we don't invest in exploration, the project pipeline can dry up quickly."

Eldorado Gold CEO George Burns on how a lack of exploration spending threatens to undermine growth. About four-fifths of survey respondents agreed.

Safe havens vs. emerging mining jurisdictions

- "For us, mining has always been a frontier business, and we're happy operating within that frontier. Developing mines in North America or Australia is not part of our current strategy. We're a bit more adventurous. But in exchange for that, we believe we bring projects that have tremendous endowment, with opportunities to operate at a lower cost, and to permit and build faster."

Fortuna Mining CEO Jorge Ganoza on why he favours growth in West Africa and Latin America over the main ‘safe havens'.

Tech role

- "The mindset of the industry needs to change to focus more on investments in technology to bring on copper production in the future, as opposed to relying on traditional exploration. People are using data analytics to define ore bodies. Technology is going to help with greenfield exploration, but our industry needs to invest more in technology to get more copper at a lower cost from existing resources. That's a real opportunity."

Freeport-McMoRan CEO Kathleen Quirk on the role of technology in unlocking future copper production growth.

Mining IQ's Leadership Insights 2025: Unlocking growth is available here. Premium subscribers can access the report for free.

-

Have your say on mining risk – and receive free insights!

MJI's World Risk Survey 2025 is now live. Rate up to three jurisdictions here (it takes 10 min) and receive a free regional section of the World Risk Insights 2025 report when it is published later this year.