The West's greatest vulnerability isn't energy or data — it's the metals that make both possible [1]

For decades, Western nations have built their technological power on materials they don't control [2].

Now, that dependence has reached its breaking point.

Across defense manufacturing, electric mobility, high-performance computing, and clean-energy infrastructure, rare earth elements (REEs) have become the backbone metals of the 21st century [3].

They power the permanent magnets inside electric vehicles, drones, wind turbines, fighter jets, and advanced robotics — the very machinery that keeps modern economies running [4].

Without them, electrification slows, innovation stalls, and the global economy would struggle to function [5].

But while demand is soaring, supply remains dangerously concentrated overseas — creating a chokehold that's starting to look like the next global energy crisis [6].

If the West doesn't take control of its supply chains now, its technological future could grind to a halt.

Governments know it. Investors are starting to see it.

And one project in Newfoundland may be quietly positioned within this unfolding macro shift: Naughty Ventures Corp. (CSE: BAD | OTC: YORKFF | FSE: 5DE) and its Bottom Brook Rare Earth Property.

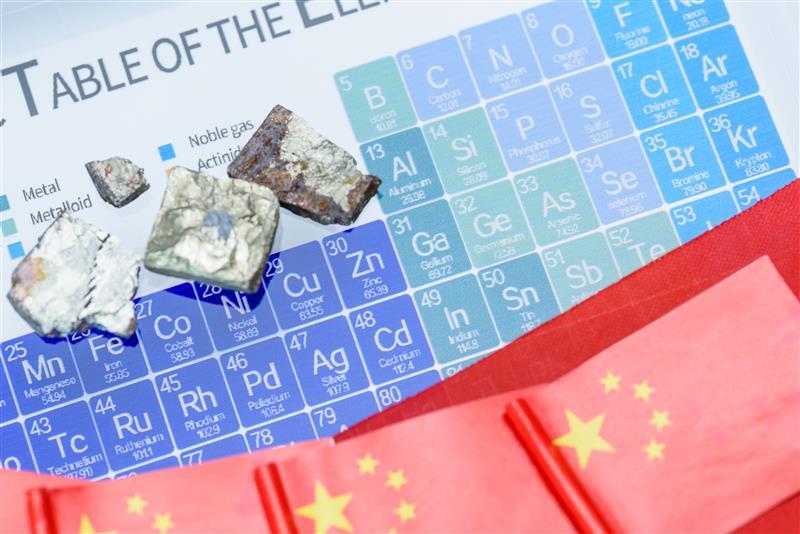

A Geopolitical Bottleneck with Economic Consequences

More than 80% of global rare-earth processing capacity is controlled by China [7], leaving the West dependent on overseas separation and refinement.

That dependency creates three escalating risks:

- Export controls that can choke Western manufacturing overnight [8].

- Price volatility that ripples through entire industries [9].

- Supply uncertainty that undermines defense readiness and clean-energy rollout [10].

The West can design its future—but someone else holds the off-switch.

That vulnerability is forcing governments to act with wartime urgency, rewiring global supply chains to secure the metals once taken for granted [11].

From Washington to Ottawa to Brussels, policymakers are mobilizing to reclaim control of the materials that matter most [12].

The momentum is clear — and early-positioned exploration companies like Naughty Ventures (CSE: BAD) stand to benefit as policy, capital, and attention shift back toward domestic sources.

Billions Flowing Into Domestic Supply Chains

The response has been swift — and historic in scale.

Between 2024 and 2025, the United States, Canada, and Europe have all unleashed multi-billion-dollar initiatives to secure the metals that underpin modern civilization [13].

In the U.S., the Department of Energy (DOE) and Department of Defense (DoD) have committed billions toward magnet manufacturing and rare-earth separation facilities [14].

Canada's Critical Minerals Strategy is funneling capital directly into exploration-stage projects located in mining-friendly provinces like Newfoundland [15].

Across the Atlantic, the European Union's Critical Raw Materials Act has set hard production targets — not suggestions — to ensure independence from high-risk suppliers [16].

Together, these policies mark a once-in-a-generation realignment of industrial strategy [17].

Critical minerals are no longer a niche concern — they're being treated as the economic and defense foundation of the 21st century [18].

This surge of public capital is already triggering a ripple effect.

Private investment is accelerating, supply-chain alliances are forming, and institutional attention is shifting toward assets that can deliver domestic stability [19].

Projects located in secure jurisdictions with access to infrastructure — like Naughty Ventures' (CSE: BAD) Bottom Brook Property in Newfoundland — are now positioned squarely in the path of that momentum [20].

For investors, this isn't a distant policy story; it's a live opportunity unfolding in real time.

Strategic Location Meets Real-World Infrastructure

On the western coast of Newfoundland, roughly 40 kilometres south of Corner Brook, sits the Bottom Brook Rare Earth Property — a land package quietly positioned inside one of Canada's most mining-friendly jurisdictions [21].

Spanning 16 mineral licences across 606 claims and covering roughly 15,150 hectares, the project lies at the intersection of geological potential and critical-mineral security [22].

Unlike remote exploration sites that face years of logistical hurdles, Bottom Brook is already connected to the grid of modern industry:

- Year-round road access

- Nearby power transmission lines

- Deep-water port adjacency

- A skilled, locally based workforce [23]

In the age of supply-chain nationalism, infrastructure has become as valuable as the resource itself.

Early exploration at Bottom Brook has already produced high-grade Total Rare Earth Oxide (TREO) intervals from historical drilling [24], hinting at the kind of mineral system that could support Western magnet supply for decades.

Several target zones across the property remain under-explored and undrilled, representing meaningful upside for follow-up programs.

Geologically, the system is anchored by monazite-enriched horizons — a host mineral found in several of the world's most productive rare-earth deposits [25].

Preliminary sampling has drawn comparisons to globally recognized monazite systems abroad — a compelling signal for further NI 43-101-compliant work and modern modelling [26].

In short, Bottom Brook sits where location, infrastructure, and policy momentum converge — giving Naughty Ventures (CSE: BAD) a credible foothold in the West's race for rare-earth independence.

The Bigger Picture: A Global Race for Magnet Metals

From electric vehicles to guided missiles, the modern world runs on permanent magnets [27].

And those magnets run on rare earth elements — particularly neodymium and praseodymium (NdPr) — the metals that convert energy into motion and power into precision [28].

As nations electrify transportation, rebuild energy grids, and automate manufacturing, global magnet demand is compounding at a pace supply chains were never built to handle [29].

Meanwhile, nearly all refining capacity remains concentrated abroad — a structural imbalance that could take a decade or more to correct [30].

That tension between runaway demand and constrained supply is creating one of the most important industrial realignments in modern history [31].

It's also drawing new attention to companies positioned in safe, mining-friendly jurisdictions — exactly where Naughty Ventures (CSE: BAD) and its Bottom Brook Property sit [32].

Rare earth independence isn't a theoretical goal anymore — it's an economic imperative [33].

And projects like Bottom Brook, with geological promise and logistical readiness, are the first links in what could become the West's next-generation magnet-metal supply chain.

The Bottom Line: Positioning Ahead of the Curve

The global realignment for critical minerals is no longer a forecast — it's underway [34].

Governments are mobilizing, capital is rotating, and the next industrial era is being built around who controls the metals that make technology move [34].

In this new reality, projects located in secure, infrastructure-ready regions are positioned to benefit first as policy shifts from discussion to deployment.

That's where Naughty Ventures Corp. (CSE: BAD | OTC: YORKFF | FSE: 5DE) enters the picture.

With a rare-earth-rich land package in Newfoundland, early geological promise, and confirmed inbound interest, Naughty Ventures stands at the intersection of timing and tailwinds [36].

As the West races to rebuild its technological independence, rare earths aren't optional — they're essential [37].

And the projects that secure them may well define the next era of industrial leadership.

For investors watching the evolution of this theme, Naughty Ventures Corp. (CSE: BAD | OTC: YORKFF | FSE: 5DE) represents exposure to the story before it becomes the headline.

References

[1] International Energy Agency (IEA), The Role of Critical Minerals in Clean Energy Transitions, 2023.

https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

[2] U.S. Department of Energy (Office of Science), Critical Materials Assessment 2023.

https://www.energy.gov/science/cmi/critical-materials-assessment

[3] European Commission, Critical Raw Materials Act Brief, 2024.

https://single-market-economy.ec.europa.eu/publications/critical-raw-materials-act_en

[4] Reuters, "Rare earth magnets drive electric vehicles and wind turbines," 2024.

https://www.reuters.com/world/china/rare-earth-magnets-drive-evs-wind-turbines-2024-05-10/

[5] World Bank, Minerals for Climate Action Report, 2023.

https://www.worldbank.org/en/topic/extractiveindustries/publication/minerals-for-climate-action

[6] International Energy Agency (IEA), Rare Earth Market Review, 2024.

https://www.iea.org/reports/rare-earth-elements

[7] Reuters, "China dominates rare earth processing capacity," June 2024.

https://www.reuters.com/world/china/china-dominates-rare-earth-processing-capacity-2024-06-01/

[8] Bloomberg, "China's Export Controls on Rare Earth Metals Rattle Markets," May 2024.

https://www.bloomberg.com/news/articles/2024-05-05/china-export-controls-on-rare-earths

[9] IMF, Commodity Market Outlook, 2024.

https://www.imf.org/en/Publications/WEO/Issues/2024/04/16/world-economic-outlook

[10] U.S. Department of Defense (DoD), Critical Minerals Strategy, 2024.

https://www.cto.mil/critical-materials/

[11] The Economist, "The West's Critical Mineral Race," April 2024.

https://www.economist.com/briefing/2024/04/20/the-wests-critical-mineral-race

[12] European Commission Press Release on CRMA Implementation, 2024.

https://single-market-economy.ec.europa.eu/news/commission-steps-implementation-critical-raw-materials-act-2024_en

[13] International Energy Agency (IEA), Tracking Clean Energy Progress, 2025 Update.

https://www.iea.org/reports/tracking-clean-energy-progress-2025

[14] U.S. DOE, Loan Programs Office Announcements (2024–2025).

https://www.energy.gov/lpo/loan-programs-office

[15] Government of Canada, Critical Minerals Strategy — 2024 Progress Update.

https://natural-resources.canada.ca/critical-minerals-strategy

[16] Official Journal of the EU, Critical Raw Materials Act, 2024.

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32024R1490

[17] World Economic Forum, Industrial Strategy in the Age of Critical Minerals, 2025.

https://www.weforum.org/reports/

[18] IMF Working Paper, Strategic Commodities, 2024.

https://www.imf.org/en/Publications/WP

[19] Financial Times, "Global Funds Accelerate Critical Mineral Investment," 2025.

https://www.ft.com/critical-minerals

[20] Naughty Ventures Corp., Company Presentation / Investor Materials, 2025.

https://naughtyventures.com/investors

[21] Newfoundland and Labrador Geological Survey, Geological Maps (2024).

https://www.gov.nl.ca/mines/geoscience/

[22] Naughty Ventures Corp., Bottom Brook Project Summary, 2025.

https://naughtyventures.com/projects/bottom-brook

[23] Naughty Ventures Corp., Infrastructure & Property Overview, 2025.

https://naughtyventures.com/projects/bottom-brook

[24] Newfoundland and Labrador Assessment Reports — Historical Drill Data.

https://gis.geosurv.gov.nl.ca/

[25] U.S. Geological Survey (USGS), Rare Earth Minerals Review, 2024.

https://pubs.usgs.gov/publication/pp1802

[26] Naughty Ventures Corp., Sampling Summary / Geochemical Highlights, 2025.

https://naughtyventures.com/projects/bottom-brook

[27] International Energy Agency (IEA), Permanent Magnets and EV Supply Chain Briefing, 2024.

https://www.iea.org/reports/permanent-magnets

[28] U.S. DOE, NdPr Critical Material Fact Sheet, 2023.

https://www.energy.gov/ne/articles/neodymium-and-praseodymium

[29] World Bank, Commodity Markets Outlook, 2025.

https://www.worldbank.org/en/research/commodity-markets

[30] Reuters, "Rare earth refining capacity remains concentrated in China," May 2024.

https://www.reuters.com/markets/commodities/rare-earth-refining-capacity-2024-05-14/

[31] Bloomberg Intelligence, "Magnet Metals and Global Supply Chains," 2024.

https://www.bloomberg.com/professional/blog/

[32] Naughty Ventures Corp., Corporate News Releases, 2025.

https://naughtyventures.com/news

[33] IMF Policy Note, Strategic Materials and Economic Security, 2024.

https://www.imf.org/en/Publications

[34] OECD, Industrial Materials Outlook, 2025.

https://www.oecd.org/sti/industrial-materials/

[35] International Energy Agency (IEA), Critical Minerals Market Review, 2025.

https://www.iea.org/reports/critical-minerals-market-review-2025

[36] Naughty Ventures Corp., Exploration Updates, 2025.

https://naughtyventures.com/news

[37] World Economic Forum, Global Risks Report, 2025.

https://www.weforum.org/reports/global-risks-report-2025/

LEGAL DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Naughty Ventures Corp. ("Naughty Ventures" or the "Company") has paid for the creation and distribution of various marketing materials, which may include this article, digital and video materials, landing pages, online banner advertisements, native ads, and social media investor marketing (the "Services"). This compensation creates a conflict of interest and should not be interpreted as independent or unbiased research. This communication is for informational and entertainment purposes only. Never invest purely based on this communication.

SHARE OWNERSHIP. Individuals associated with the production, publication, or distribution of this communication may buy, sell, or otherwise hold securities of Naughty Ventures for their own profit. You should assume that such parties may transact in the securities of Naughty Ventures before, during, or after the publication of this communication. This presents a substantial conflict of interest. Conduct your own due diligence and consult with a registered financial professional before making any investment decisions.

NOT INVESTMENT ADVICE. This communication does not constitute investment advice, nor does it provide individual recommendations. Naughty Ventures is not registered or licensed with any securities regulatory authority in any jurisdiction to provide investment advice. Always consult a licensed financial advisor before making investment decisions.

FORWARD-LOOKING STATEMENTS. Certain statements contained in this communication may constitute "forward-looking statements" under applicable securities laws. These statements involve risks, uncertainties, and assumptions. Factors that may cause actual results to differ materially include, but are not limited to: commodity price volatility, regulatory changes, permitting risks, exploration uncertainty, financing availability, geopolitical factors, and general economic conditions. There is no guarantee any forward-looking statement will come to fruition. Naughty Ventures undertakes no obligation to update forward-looking statements except as required by law.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to buy/sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.

THIRD-PARTY INFORMATION. Certain information contained herein regarding adjacent properties, peers, or comparable projects is derived from publicly available sources that have not been independently verified. Mineralization on adjacent or comparable properties is not necessarily indicative of mineralization on the Company's properties.

NO GUARANTEE OF RESULTS. Mineral exploration is speculative. Even with promising targets or historic data, there is no guarantee of defining a commercial resource, of economic extraction, or that exploration work will yield similar results to previous operators.

INDEMNIFICATION / RELEASE OF LIABILITY. By reading this communication, you agree to hold harmless Naughty Ventures, its representatives, affiliates, and partners from any liability associated with your investment decisions. You are solely responsible for evaluating risks.

PRIVACY, COOKIES, AND DATA PROTECTION. Personal information may be collected during interaction with this communication or associated landing pages for marketing and analytics purposes. For details on data handling practices, cookie usage, and opt-out rights, please refer to the Company's Privacy Policy.

ABOUT THIS COMPANY

Naughty Ventures Corp

Address:

3012 Murray Street, Port

Moody, British Columbia, V3H 1X2

Phone: +1 604-346-7613

Email: info@naughtyventures.com

Website: https://www.naughtyventures.com

Social Media: