Cashed-up new explorer Ballard Mining has burst onto the ASX and is buoyed by infill drilling results as it prepares to pivot from development towards the growth target in its dual-stream strategy.

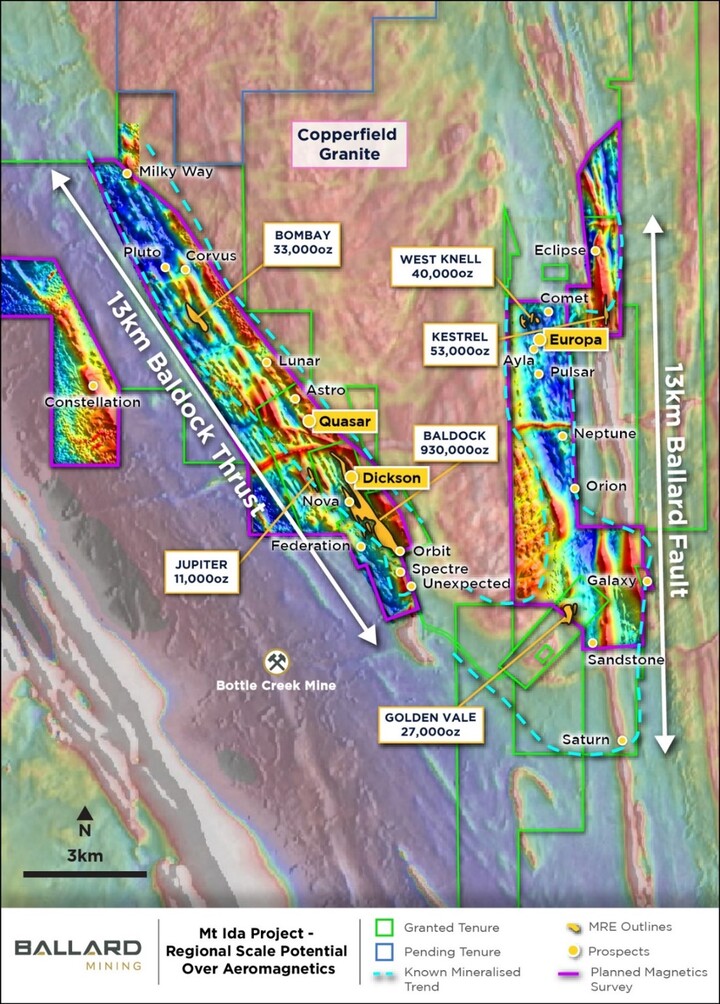

Ballard listed on the ASX in July after successfully demerging from Delta Lithium, set up with a 1.1 million ounce resource grading 3.3g/t gold at its flagship Mt Ida project in Western Australia's Goldfields.

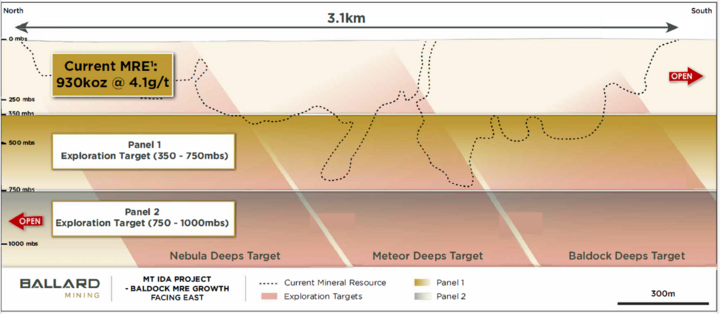

The bulk of the resource is in the fully-permitted Baldock deposit, which hosts 930,000oz at 4.1g/t on a granted mining lease and has been the focus of initial infill drilling.

The 80,000m program is 90% complete this week and has been yielding strong results, which Ballard has reported on with five separate ASX announcements and consistent terminology that the results are confirmatory and in line with expectations.

"We expect to achieve our objective of resource conversion that will support an initial 400-500,000oz ore reserve by the middle of next year, once geotechnical and metallurgical studies are completed," managing director Paul Brennan said.

He's also confident of Baldock extending at depth, pointing to analogues with Agnew to the north which is being mined 1.4km deep, and Ora Banda to the south finding mineralisation at 1,000m on the same greenstone belt.

"These orogenic deposits plumb deep, so the more we can leverage off the fully permitted Baldock, the better," he said. "Once the initial backbone of capital infrastructure such as the decline and ventilation is established for the underground mine, everything from that point becomes incremental.

"We expect 60% of our resource growth to come from Baldock and the remainder to come from systematically working our way through the 53 regional exploration targets that we've identified."

Resource growth

With A$40 million in the bank, Ballard's focus for 2026 is growing the resource base.

"Permitting is behind us, we expect to come out with a maiden ore reserve at Baldock which will support an initial 5-6 year mine life, our drill program for the next 12 months is fully funded, and we have clear blue skies ahead to focus on building scale," Brennan said.

Phase two drilling is now underway at Neptune, 7km from Baldock. It's the first regional target Ballard has drilled and its first discovery, where results included 23m at 1.8g/t from 21m.

"It's a more comprehensive drill program, that should underpin a maiden resource for Neptune – and that same logical playbook will just apply for all the other targets," Brennan said.

"We are very excited about the potential for camp scale at Mt Ida and we will know what we have in 12 months' time."

Looking ahead

The coming year should deliver plenty of assay results, a maiden reserve for Baldock and potentially global resource updates in a positive gold environment, with the price hitting record highs this year and remaining above A$6,200/oz.

Ballard will also continue working towards starting mining at Baldock, which is now fully permitted for openpit and underground mining and processing.

"We expect to reach a final investment decision for Baldock towards the end of 2026, once we achieve our target of approximately a 2Moz global resource, which should support a circa 10 year mine plan," Brennan said.

"We've been very fortunate due to the work that was done by Delta prior to the demerger, and with advanced permitting status and high grade, they are the two key differentiators between us and the rest of our peer group.

"We're in a very fortunate position and it's a pretty exciting time for the company."

ABOUT THIS COMPANY

Ballard Mining

ABOUT THIS COMPANY

Ballard Mining

HEAD OFFICE

Level 2, 18 Richardson Street West Perth WA 6005

Telephone: +61 8 6466 7500

Email: info@ballardmining.com.au

Web: www.ballardmining.com.au

Socials: LinkedIn

DIRECTORS

Simon Lill

Paul Brennan

Tim Manners

Stuart Mathews

James Croser

QUOTED SHARES ON ISSUE: 454.6 million

MARKET CAP (at February 13,2026): A$366 million