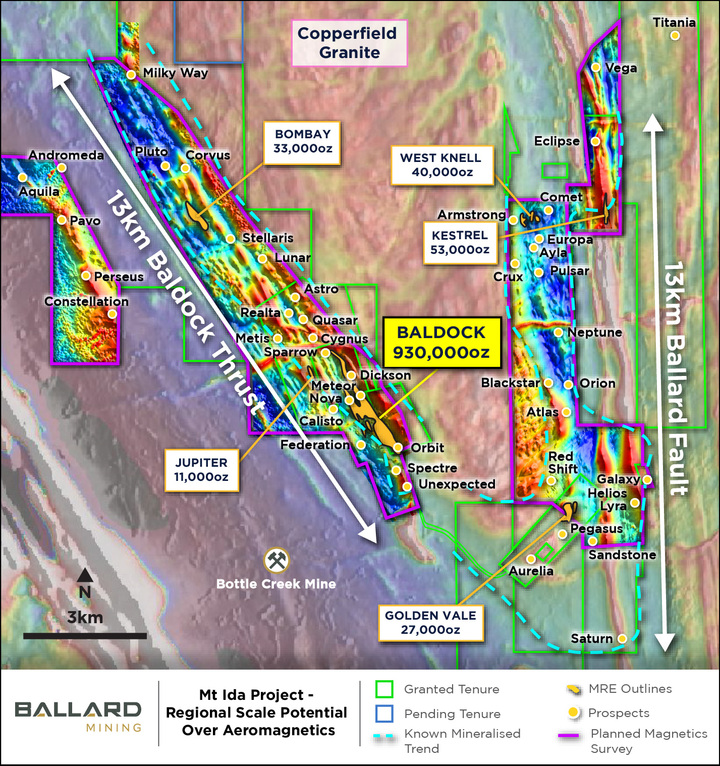

Ballard Mining has kicked off a focused resource growth campaign, with its eye on the prize of establishing a standalone, decade-long gold operation at its flagship 1.1 million ounce Mt Ida project in the Goldfields.

Armed with a dual strategy of project development and resource growth, the company spent the first six months since listing in mid-2025 derisking and cementing the development pathway at Mt Ida's key Baldock deposit.

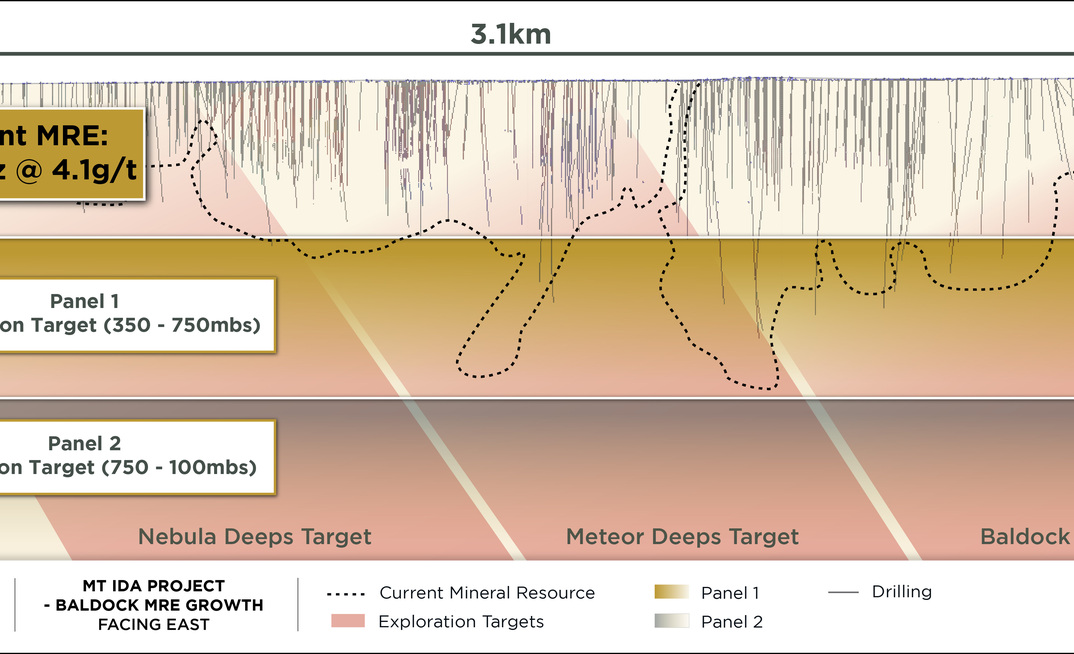

Baldock, which hosts 930,000 ounces grading 4.1g/t and is fully permitted for openpit and underground mining and processing, is expected to provide the baseload feed for a targeted 8-10 year mine life at Mt Ida.

The company plans to leverage off Baldock as it turns its aspirations to achieve a substantial mineral resource and the entire workforce is incentivised to achieve 1.5Moz and 2Moz milestones, managing director Paul Brennan explains.

"We already know there's a 5-6 year mine at Baldock based on the infill drilling we've completed," he said.

"We expect to be able to announce a maiden ore reserve at Baldock of 400,000-500,000oz by mid-2026 – now our strategy is simply to add scale at Mt Ida.

"About 60% of the 2026 exploration effort will be targeting resource growth along strike and at depth at Baldock.

"Once the decline, ventilation, escapeway network, power and other services are established, the extraction of additional identified resources becomes an incremental opportunity, so it is logical to leverage off Baldock as much as possible - sweat the asset!"

Deeper potential beckons at Baldock

To date, Ballard has only drilled Baldock to 350m deep and Brennan believes there is plenty of potential at depth.

"Shear-hosted orogenic gold deposits typically plumb deep, like the 1.4km deep Agnew gold mine 150km to the north, and Ora Banda's Riverina Deeps plus-1km deep mineralised system about 80km to the south," he said.

"Agnew and Ora Banda are located on same greenstone belt, hence Ballard's confidence in the targeted resource growth to come from its planned drilling of 350-750m depth at Baldock."

The remaining exploration effort will be split between 53 targets, focusing on regional resource growth at the Kestrel, Golden Vale, West Knell and Bombay deposits, which currently host a combined 164,000oz.

The regional effort will also search for fresh resource opportunities and follow up on prospects including Pluto where initial drilling announced in December returned 5m at 9.4g/t from 46m.

With about A$30 million in the bank towards the end of 2025, Brennan said it was time to "pin the ears back" and get to work to determine whether Mt Ida held a genuine camp-scale opportunity.

"We've been fortunate in terms of spinning out of Delta Lithium last year with advanced permitting status and coming out of the starting blocks with a 1Moz resource," he said.

"Now, we're fully permitted at Baldock and we have a works approval in place for a 2 million tonne per annum processing plant and a 3.7 gigalitre a year water abstraction licence.

"We've got confidence in the orogenic nature of the deposit, we've derisked the first five years and all the permitting is behind us.

"Now we've got the luxury of drilling for scale."

ABOUT THIS COMPANY

Ballard Mining

ABOUT THIS COMPANY

Ballard Mining

HEAD OFFICE

Level 2, 18 Richardson Street

West Perth WA 6005

Telephone: +61 8 6109 0104

Email: info@ballardmining.com.au

Web: www.ballardmining.com.au

Socials: LinkedIn

DIRECTORS

Simon Lill

Paul Brennan

Tim Manners

Stuart Mathews

James Croser

MAJOR SHAREHOLDERS:

Delta Lithium 41.4%, Aurenne Group 9.6%, Hancock Prospecting 5.6%

Mineral Resources 5.1%, Board and management 5.4%

QUOTED SHARES ON ISSUE: 222.04 million

MARKET CAP (at January 13,2026): A$156.54 million