Managing director and CEO Archie Koimtsidis describes Namdini as one of the world's major recent gold discoveries.

The company released the encouraging preliminary economic assessment (PEA) for Namdini earlier in February and expects to continue to generate positive news flow in the coming months from an imminent resource update, its ongoing drill campaign, metallurgical optimisation work and greenfield exploration assets.

"Given the current drill programme underway, growing mineral resources and positive PEA for Namdini, the company believes it will outperform its peer group over the next year," Koimtsidis said.

It has commenced the prefeasibility study, which is expected to be completed mid-2018.

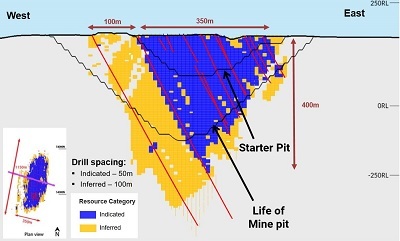

The full scale of the project is yet to be determined - at this point, Cardinal is planning to develop Namdini as a large-scale openpit, with a low strip ratio of 1.2:1 waste to ore, to a depth of over 300m.

But as Koimtsidis points out, the resource remains open at depth and along strike and extension and infill drilling is ongoing.

This month's PEA outlined a 4.5 million tonne per annum, 7Mtpa and 9.5Mtpa development option, with capital costs ranging from US$275 million to $426 million, all-in sustaining costs between $701-$794/oz and annual production from 159,000oz up to 330,000oz.

The project payback was between three to four years in all three options, and the post-tax NPV (using a 5% discount) went from $706 million to $1.04 billion.

The proposed Namdini starter pit

It also identified a higher-grade starter pit option yielding more than 1 million ounces of gold and other value-enhancing opportunities, such as an improved plant design.

As for which development option would take precedence, Koimtsidis said the preferred result would likely surface from ongoing study work this year.

He said the company evaluated the three development scenarios in the PEA to showcase the value and viability of the Namdini deposit in all scenarios.

"We are fortunate the Namdini deposit provides a higher-grade starter pit at surface, with extremely low strip ratios, which allows for quick investment payback for all options," he said.

"This provides opportunities for the full range of new and existing shareholders and investors.

"The robustness of the PEA in its entirety has provided investment certainty in Cardinal on a number of fronts such as IRR, NPV, life of mine and costs, both capital and operating."

The company has a busy scheduled planned, with the approvals process underway, a resource update expected this quarter and a metallurgical optimisation study underway alongside the PFS, due mid-year.

The anticipated resource update will build on the update announced in September of 4.3Moz indicated and 3.1Moz inferred, using a 0.5g/t cutoff.

Cardinal has also submitted its Environment Impact Assessment scoping report to the Ghanaian Environmental Protection Agency.

"The resource update is progressing well and Cardinal has continued with the same tier one and West African specialist consultants in the PFS which allows for good continuity assisting in achieving our milestones," Koimtsidis said.

"We remain on track."

One aspect he is particularly proud of is Cardinal's low, $6/oz discovery cost.

"This impressive KPI against our peers demonstrates Cardinal's commitment to invest shareholder money in the area which has provided successful returns per additional ounces discovered and a significant resource upgrade for the Namdini project to 7.4Moz," he said.

"What is really unique about the Namdini deposit is its sheer size, being some 300-350m wide and about 1,100m long and open at depth.

"With the deposit size and the focus of our team to put as much into drilling as possible, the ounce count per vertical metre is significant, which contributes to such a low cost per ounce discovered."

Cardinal was recently granted a 15-year renewable mining licence, which Koimtsidis said demonstrated its positive in-country relationships at both local and government level.

Koimtsidis splits his time between Ghana and the Perth head office and director Malik Easah is based in-country.

Koimtsidis said the company had engaged with the local community for more than 20 years and they appreciated the importance of Namdini to the economic development of northern Ghana.

"Cardinal is currently fully vested in Ghana on both a local and government level," he said.

"Community relationships were forged many years ago, as demonstrated by ongoing local support of the community leaders in developing the Namdini project.

"On a government level, the Namdini project is recognised to enable an uplift to the northern parts of Ghana commercially and, when developed, will provide significant upskilling, development and infrastructure opportunities on a sustainable basis to all Ghanaian citizens."

Aside from Namdini, Cardinal also has exploration planned for its Kungongo, Ndongo and Bongo projects in the north and Subranum in the country's south.

"Cardinal is continuing with its active exploration in the areas of strategic interest," Koimtsidis said.

Cardinal Resources CEO and MD Archie Koimtsidis

"Its exploration programme is continuing in parallel to the Namdini project without interruption."

He said the company had comprehensive airborne magnetics coverage of its extensive land holdings and, further, had completed regional auger soil campaigns that delineated many structural targets requiring follow up with detailed programmes including drilling.

"Currently, we are in the process of conducting further airborne EM surveys to aid in prioritising the multitude of gold targets defined from sampling and mapping," he said.

However, Cardinal's main priority is progressing Namdini.

"Namdini is seen as one of the major recent gold discoveries globally," Koimtsidis said.

"The gold occurs in one large wide deposit, is ubiquitous throughout and we have the benefit of being able to segregate the gold-hosting sulphides from the host rock to reduce processing costs.

"Further, the higher-grade starter pit with some 1Moz as included with the release of the PEA, will enhance the payback of capital and the PEA demonstrates that the project is economically robust in any of the scenarios chosen.

"Cardinal remains significantly undervalued given the size, quality and scarcity of deposits like Namdini."

ABOUT THIS COMPANY

Cardinal Resources

An African gold-focused exploration and development company.

HEAD OFFICE:

- Suite 1, 28 Ord Street, West Perth WA 6005

- Telephone: +61 (8) 6558 0573

- Email: info@cardinalresources.com.au

- Web: www.cardinalresources.com.au/

DIRECTORS:

- Archie Koimtsidis

- Kevin Tomlinson

- Malik Easah

- Dr Kenneth G. Thomas

- Michele Muscillo

- Trevor Schultz

QUOTED SHARES ON ISSUE:

- 494 million

MARKET CAP (at Nov 14, 2019):

- A$167.94 million

MAJOR SHAREHOLDERS:

- Gold Fields (Australia) 16.41%

- 1832 Asset Management (Canada) 6.28%

- Van Eck (USA) 5.02%

- Royal Bank of Canada (Canada) 2.78%

- Sprott (Canada) 1.96%