The world's most attractive mining projects are revealed in a new report by Mining Journal Intelligence (MJI) – with Canada dominating a top-50 table headed by uranium and gold assets.

MJI's Project Pipeline Handbook 2024 report identifies today's best mining projects using a unique, objective evaluation method to rate 459 assets globally with combined capex of US$212 billion. Scores are calculated with 25 data points collected from economic studies (ranging from PEA/scoping to feasibility stages) to provide ratings across six categories: Economics, Jurisdiction, Confidence, Financeability, Engineering/metallurgy, and Geology.

The categories (which are individually weighted) are used to calculate an overall project score out of 100. A free webinar to discuss key findings of the Project Pipeline Handbook 2024 with mining investor Rick Rule will be held on June 11.

Top projects

Two Canadian uranium projects took the top spots in the 2024 report; Denison Mines' Phoenix (Wheeler River) was first at 93 out of 100, aided by low-cost in-situ recovery methods and high grades, with NexGen Energy's Rook I a point lower at 92. Both are in Saskatchewan's Athabasca Basin region.

The performance of uranium assets was supported by a surge in prices driven by expectations of a nuclear power revival, with governments seeking to reduce reliance on fossil fuels and reduce dependence on Russian gas. Higher spot prices and resulting hikes in company market capitalization contribute to improved scores in the Economics, Financeability and Confidence categories.

Skeena Resources' Eskay Creek gold project in British Columbia – the top-scorer in last year's report – was the third this year at 89, bolstered by a solid feasibility study in November, which put post-tax NPV at C$2 billion and IRR at 43% at US$1800/oz gold prices, with production at 320,000ozpa gold equivalent.

Gold prices have also performed well, although spot prices used in the scoring of about $2000/oz were taken in mid-February, weeks before a substantial uptick.

With Bathurst Resources' recently acquired Tenas steelmaking coal asset in British Columbia ranking fifth, just one asset in the top five was outside Canada: Rupert Resources' Ikkari gold project in Finland, scoring 87.

Battery minerals, base metals

Taseko Mines' Florence and Excelsior Mining's Gunnison copper assets in Arizona were the top base metals projects, both scoring 81, a figure matched by Arcadium Lithium's James Bay lithium asset in Quebec, the top-ranked battery minerals project.

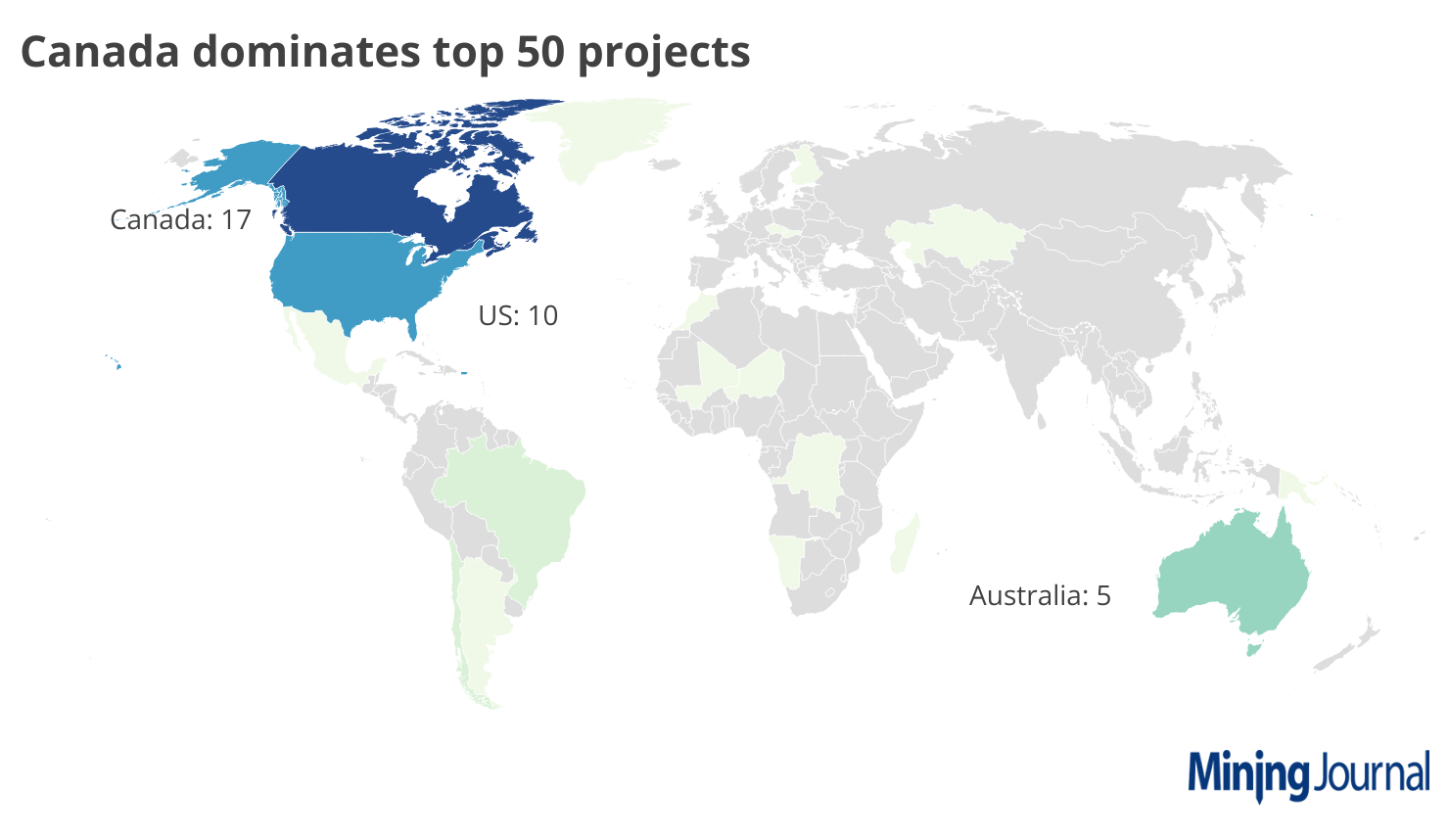

Out of the top 50 projects 17 were in Canada, followed by the US, with 10, Australia (five), and Brazil and Chile, with two each. The remainder were in Europe and the former Soviet Union, Africa, South America, and Oceania.

As well as project-specific metrics, Canadian and US projects were helped by strong scores in the Jurisdiction category, calculated using Investment Risk Index figures taken from MJI's World Risk Report 2023 (feat. Minehutte ratings). Canada and the US were the lowest-risk mining regions in the report.

Only projects for which results of economic studies are publicly available are rated. Assets are removed when they enter production. Data from more than 200 new economic studies have been added since the 2023 report was released.

MJI's Project Pipeline Handbook 2024 e-reader report is available to buy here and can be accessed for free by Premium subscribers.

Mining Journal Select London 2024, featuring presentations of high-scoring projects assessed by MJI, takes place on July 1-2. For details visit miningjournalselect.com

TOPICS:

- mining journal intelligence

- Wheeler River

- Rook 1

- Saskatchewan

- Eskay Creek

- Tenas

- Gunnison

- Florence copper project

- Ikkari

- Mining Journal Select 2024

- Project Pipeline Handbook 2024

- Uranium

- Gold

- Copper

- Lithium

- Canada

- Denison Mines

- NexGen Energy

- Skeena Resources

- Bathurst Resources

- Taseko Mines

- Rupert Resources

- Excelsior Mining