Argentina Lithium & Energy Corp.is focused on acquiring high quality lithium projects in Argentina with the objective of advancing them towards production.

The increase in appetite for lithium from the battery sector shows no sign of slowing down any time soon with global demand expected to double between 2025 and 2030 to surpass 2.4 million metric tons per annum (MMTA) of lithium carbonate equivalent. There is much to suggest Argentina can increase further its contribution to servicing that demand, given it forms part of the "Lithium Triangle" that hosts some 60% of the world's known reserves of lithium, often referred to as "white gold". Argentina's identified resources are 20 million tons, placing it second in the world, behind only Bolivia which has yet to develop a meaningful lithium industry.

Argentina Lithium & Energy is supported by the Grosso Group, a management company with a pedigree of success in Argentina's resource sector, as well as expertise in government and community relations. Argentina Lithium is well positioned to be a significant player in the lithium sector via its highly prospective Rincon West and Antofalla North projects in Salta province, northwest Argentina. Alongside Pocitos and Incahuasi, these four constitute the company's project portfolio.

Assisting the company's pathway to explore, develop and advance these projects is a recent strategic investment by Peugeot Citroen Argentina, a subsidiary of leading global automaker, Stellantis. Market trends and policy efforts in major car markets have led the International Energy Agency (IEA) to revise its global outlook for EV sales as a proportion of total car sales upwards to 35% by 2030. Funding Argentina Lithium & Energy represents for Stellantis a way to help ensure potential future security of supply for one of the critical battery metals it will need in abundance to survive and prosper.

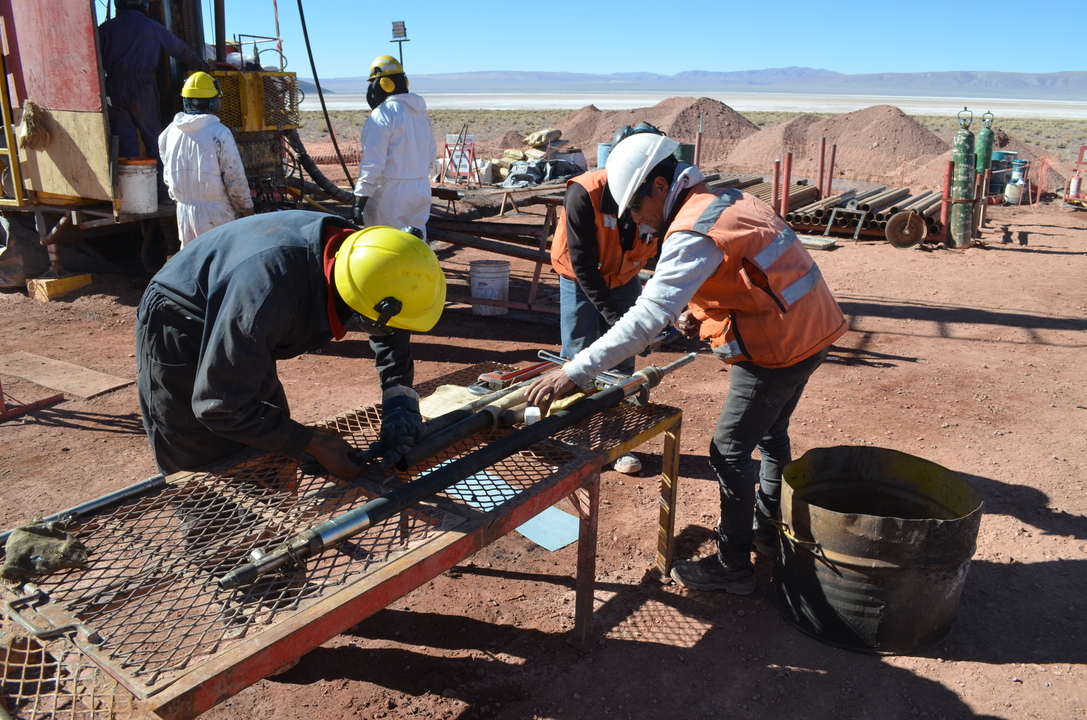

The lithium being targeted by Argentina Lithium & Energy is held in salt lake or ‘salar' brines, and recent drilling at Rincon West has confirmed the grade potential of the concentrated lithium-bearing aquifer tested by the holes to date at the project. Meanwhile, at Antofalla North, while drilling is pending, the company's geophysics demonstrate a deep salar basin with prospectivity for lithium brines; a comprehensive drilling plan has been made to explore the project.

Having worked in a consultative capacity for the Grosso Group since the mid-1990s, Miles Rideout is the man now tasked with overseeing exploration of its lithium projects. He brings to the table an intimate knowledge of the Argentina lithium space built up over 15 years. In conversation with Mining Journal, he described it as "a pleasure working with a group where every department is expert at their jobs".

Alongside the anticipated boom in demand for lithium over the next decade, projected to reach 3.8 MMTA by 2035, Rideout spoke of new direct lithium extraction (DLE) technologies which come with scope to increase production and reduce environmental impact as something about which he is especially excited. He sees both as having the potential to boost the future economic case for the company's projects.

Argentina Lithium & Energy‘s Rincon West and Antofalla North projects are located on mid-grade salars, and also adjacent to properties held by major mining companies; respectively, Rio Tinto (www.riotinto.com) and Albemarle Corporation (www.albemarle.com).

In respect of Rincon West, the first drilling objective was to demonstrate brines that were comparable in composition to other successful advanced lithium projects, and that has been borne out in the results published to date. Additional work is now underway to determine the extent of the brines and their amenability to recovery and processing. This work will be the basis of an initial mineral resource estimate for the project, which the company is working towards completing in 2024.

It is a similar story with the much larger Antofalla North project, which is in late stage permitting for exploration. Here, Albemarle, the world's second largest lithium producer, is Argentina Lithium & Energy's neighbour to the immediate south. The Antofalla North property extends over 27 km of the salar from the northern border of Albemarle right to the northern edge of the salt basin. While the project is yet undrilled, historic geophysics demonstrate the basin to be as much as 500m in depth. It is anticipated drills will start running in early 2024 once permits are in place.

Should lithium grades be comparable to grades at producing deposits in the region, Rideout indicated this could become the primary focus of attention, given it is more than twice the size of Rincon West. He explained, however, that "either one is potentially a company building project".

As to the strategic investment from Stellantis, Rideout described the automaker as having "a very ambitious program for lithium carbonate".

Specifically, Stellantis' subsidiary took a 19.9% interest in the Argentina Lithium & Energy's Argentine subsidiary by investing the equivalent of US$90m of funding in Argentine pesos, to fund the Company's exploration and development activities. The associated offtake agreement means it has a right to purchase 15,000 tonnes a year of lithium carbonate equivalent if Argentina Lithium & Energy enters commercial production on any of its current projects. Stellantis also has first right of refusal above and beyond that figure, with the agreement initially in place for seven years.

Rideout explained that with the funding provided by Stellantis, the company can fast-track exploration and initial resource modelling work and, if successful, develop a plan to advance its core projects towards production.

The Argentina Lithium & Energy vice president of exploration is keen to draw attention to the positive jurisdictional dynamics that prevail. For Salta and Catamarca provinces, where the company's properties are located, and which exercise more responsibility than the federal government in respect of mining regulation, lithium exploration and development provides a much-needed route to economic development for its high plains communities. Not only does it offer employment opportunities and a pathway to infrastructure development in the region, but once in production any such project would pay a 3% net smelter royalty to the province in which it sits.

Despite the region's remoteness, Argentina Lithium & Energy's projects enjoy year-round road access, as well as proximity to population centers and power lines.

As Rideout explained, "When exploring, I prefer to invest in the property development and the exploration drilling, rather than building a road at a cost of a million dollars before I can start any work".

In some other provinces there can be competing business interests between mining and agriculture. In such instances, landowners can see mining as a threat their business model, which is predicated on low-cost wages and a ready availability of seasonal workers. Of significance here, however, is that Rideout detects no anti-mining sentiment in either Salta or Catamarca.

Both provinces have had operating mines for decades, are synonymous with a well-developed regulatory framework and have accessible mining departments. Not only does Argentina Lithium & Energy regularly appraise the authorities of its advances, but should it need clarification on how best to proceed, it can readily consult with the relevant high-level officials.

In addition, the recent national election, won by Javier Milei represents what Rideout described as potentially "an improved and favourable business environment".

He added, "We will be looking [to the new government] for freer trade and commerce, and less monetary regulation. That will be important as we advance our projects in respect of bringing technology and machinery from abroad and with building our infrastructure".

All told, exciting times for Argentina Lithium & Energy.

ABOUT THIS COMPANY

Argentina Lithium & Energy

HEAD OFFICE

- Address: Suite 411 - 837 West Hastings Street, Vancouver, BC, Canada, V6C 3N6

- Email:info@argentinalithium.com

- Web: www.argentinalithium.com

SOCIAL MEDIA

DIRECTORS

- Joseph Grosso

- Nikolaos Cacos

- John Gammon

SHARES ON ISSUE

- 131.1 million